Flipkart Loan Apply Kaise Kare:-dosto, aaj ke samay mein kayi companies aur online platforms loans provide kar rahe hain. Is article mein hum aapko guide karenge ki Flipkart ke through personal loan kaise apply karein. Main aapko inform karna chahunga ki Flipkart ke through aap minimum ₹10,000 se lekar ₹5 lakh ya usse bhi zyada ka personal loan prapt kar sakte hain.

Agar aap Flipkart app ka istemal karte hain, toh yeh khabar aapke liye acchi hai. Ab Flipkart apne application ke through personal loans bhi offer karta hai. Jab kisi ko paise udhaar lena possible nahi hota, aise mein banks ya Flipkart application aapko loan provide kar sakte hain. Is article mein, hum aapko batayenge ki Flipkart ke through loan apply kaise karein, jisse aap sabhi zaruri jaankari ikhatta kar sakein.

hum aapko bataenge ki Flipkart Loan Apply Kaise Kare, yaani ki kaise 2023 mein Flipkart Personal Loan ke liye online application submit karein. Online apply karne ke baad, aap directly Flipkart app se ₹10,000 se lekar ₹500,000 ya usse bhi zyada ka loan receive kar sakte hain. Iske liye, aapko ek online application submit karna hoga. Niche, humne step by step, simple language mein puri details share ki hui hai ki Flipkart Loan Apply Kaise Kare. Isse padhkar, aap detailed information prapt kar sakte hain.

Table Of Contents Hide Flipkart Loan Apply Kaise Kare – Highlights |

| Name Of Article | Flipkart Loan Apply Kaise Kare |

| Type of Article | Others |

| Name of the Bank | Flipkart |

| Apply Mode | Online |

| Who Can Apply? | Every Flipkart Apps User Apply |

| Type of Loan | Personal Loan |

| Name of the App | Flipkart Apps |

| Loan Amount | ₹10,000 Up to ₹5+ lakh |

| Official Website | Flipkart |

Hatho-Hath Minto Me Flipkart Se Personal Loan 5 Lakh Se Bhi Jyda Ka Aise Le AIse Kare Khud Se Apply – Flipkart Loan Apply Kaise Kare

Namaste sabhi pyaare readers ko, hum aapka swagat karte hain is article mein. Is article mein, hum aapko bahut hi simple tareeke se samjhayenge ki Flipkart Loan online kaise apply karein aur kaise aap 5 lakh se zyada ka loan prapt kar sakte hain. Agar aap chahate hain ki aapko poori process ke saath saath detailed information bhi mile, toh dhyan se neeche di gayi jaankari padhein, aur aap samajh jayenge ki Flipkart Loan ke liye kaise apply karein.

Aapko maloom hona chahiye ki Flipkart ek online platform hai jo alag-alag services provide karta hai. Aap yahan se online shopping kar sakte hain aur Flipkart se EMI loans bhi le sakte hain. Ab Flipkart ne shuru kiya hai Flipkart users ko loans provide karna. Isliye, is article mein hum aapko guide karenge ki Flipkart Loan Apply Kaise Kare, yaani ki kaise aap Flipkart se personal loan ke liye apply karein aur kaise aap 5 lakh se zyada ka loan Flipkart se prapt kar sakte hain. Niche detailed information di gayi hai, jo aapko poora loan application process samajhne mein madad karegi.

Aakhir mein, Flipkart Loan Apply Kaise Kare aur latest updates ke liye aap regularly is website ko visit kar sakte hain. Important Links section mein neeche Flipkart Loan ke liye apply karne ka direct link diya gaya hai. Is link ka istemal karke aap aur adhik jaankari prapt kar sakte hain.

Flipkart Loan Apply Kaise Kare Kaun Eligibility

Flipkart Loan Eligibility:

Eligibility criteria alag-alag ho sakti hai, lekin kuch common factors hote hain:

- Flipkart Account Honaa Chahiye: Aapko ek active Flipkart account hona chahiye.

- Age Criteria: Aapki umar 21 se 60 ke beech honi chahiye.

- Stable Income: Regular income source hona zaroori hai, taki aap loan repay kar sakein.

- Good Credit History: Aapki credit history bhi ek important factor hai. Achi credit history wale applicants ko preference di jaati hai.

Flipkart app ya website par jakar specific eligibility criteria ko check karna hamesha behtar hota hai, kyunki yeh time to time badal sakti hai.

Flipkart Loan Apply Kaise Kare Benefits

Flipkart Loan apply karna ke kuch fayde hain:

- Saral Application Process: Flipkart Loan ke liye apply karna bahut hi aasan hai. App mein kuch hi steps mein aap online application complete kar sakte hain.

- Flexible Loan Amount: Aap Flipkart Loan ke zariye ₹10,000 se lekar ₹5,00,000 ya usse bhi zyada tak ka loan le sakte hain, aapki eligibility ke hisab se.

- Quick Approval: Kuch cases mein, Flipkart Loan ka approval turant ho sakta hai. Jise aap jaldi se apne financial needs ke liye utilize kar sakte hain.

- Convenient Repayment Options: Aapko various repayment options milte hain, jisse aap apne convenience ke hisab se EMI pay kar sakte hain.

- No Collateral Required: Flipkart Loan personal loan hai, ismein aapko koi collateral provide nahi karna padta, jo traditional loans mein common hota hai.

- Access Through Flipkart App: Aapko loan ke updates, repayment schedule, aur statements Flipkart app ke through easily milte hain.

- Exclusive Offers for Flipkart Users: Kabhi-kabhi Flipkart Loan ke users ko exclusive shopping deals ya discounts bhi milte hain.

Dhyan Rahe: Yeh important hai ki aap loan lene se pehle saare terms and conditions ko acche se samajh lein aur repayment capability ko dhyan mein rakhein. Iske alawa, loan apply karte waqt diye gaye details sahi taur par fill karein.

Quick Step to Flipkart Loan Apply Kaise Kare 2023-24?

Agar aap ek bahut hi simple tareeke se Flipkart Loan apply karne ka poora process janana chahte hain, toh aap neeche diye gaye steps ko padhkar Flipkart Loan online apply karne ki puri jaankari prapt kar sakte hain. Flipkart Loan Apply Kaise Kare ka process is tarah se hai:

- Google Play Store Kholein: Apne internet-connected smartphone mein Google Play Store ko kholen.

- Flipkart Search Karein: Google Play Store mein search option par click karein, aur Flipkart search karein. Search bar mein “Flipkart” type karein, jaise ki neeche dikhaya gaya hai –

- Flipkart App Install Karein: Flipkart ka app milega, usko install karein apne phone mein.

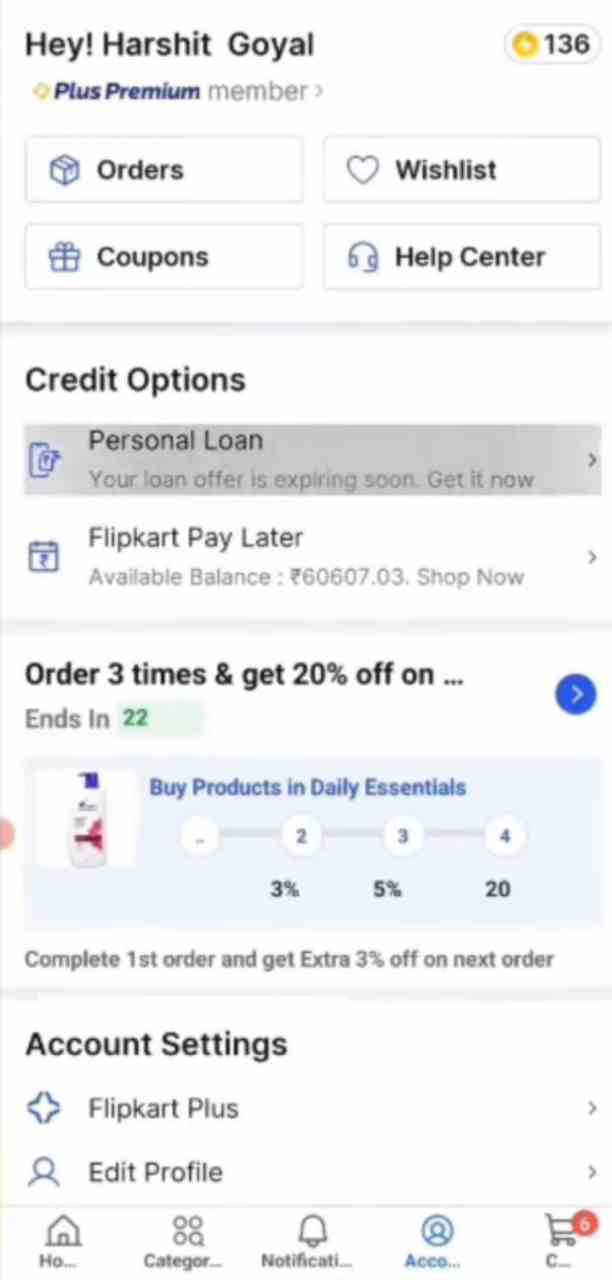

- Flipkart App Kholen Aur Login Karein: Flipkart app ko kholen aur apne Flipkart account mein login karein.

- Financial Services Ya Loans Section Mein Jaayein: App ke menu mein jaakar ‘Financial Services’ ya ‘Loans’ section ko dhoondein aur usmein jayein.

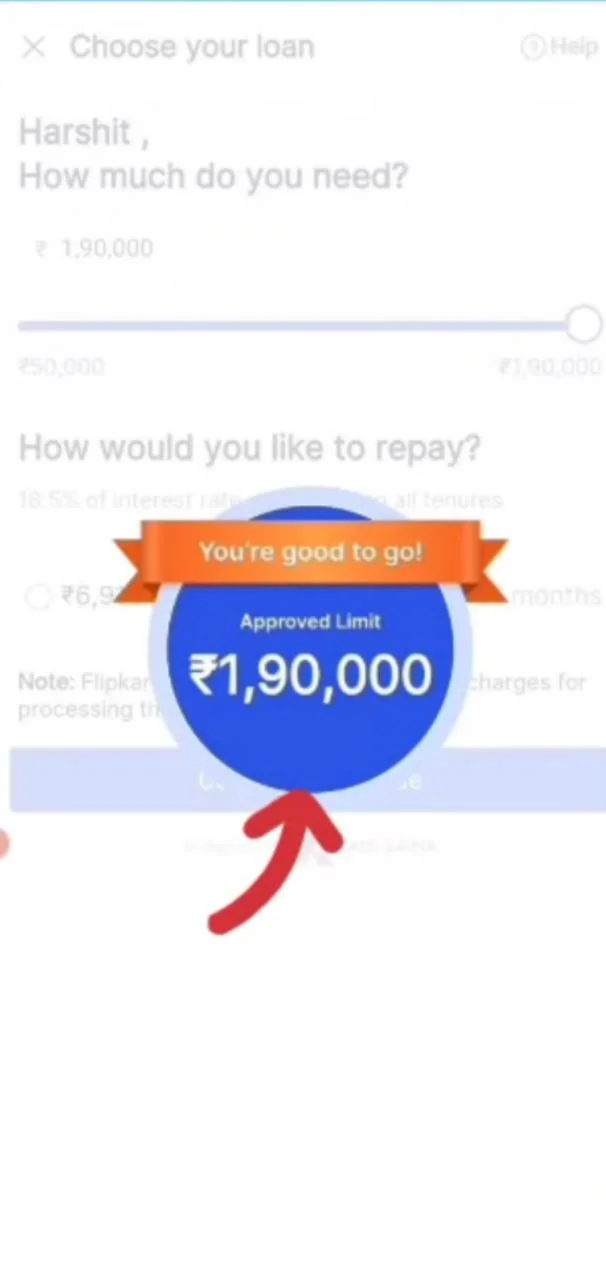

- Loan Type Aur Amount Chunein: Yahaan se personal loan type chunein aur loan amount ko select karein, jo aapko chahiye.

- Personal Aur Financial Details Bharayein: Online application form ko bharne ke liye apne personal aur financial details provide karein.

- Required Documents Upload Karein: Jo bhi documents maange jaayein, unhe clear aur readable taur par upload karein.

- Review Karein Aur Submit Karein: Apne diye gaye information ko dhyan se check karein, aur agar sab kuch sahi lagta hai toh application ko submit karein.

- Approval Ka Intezaar Karein: Ab aapko approval ka wait karna hoga. Flipkart ya unke financial partners aapke application ko review karenge.

Is tarah se, aap Flipkart Loan apply karne ka pura process follow kar sakte hain. Dhyan rahe ki har loan application ka process alag hota hai, isliye di gayi instructions ko carefully follow karein. Aur haan, latest updates ke liye regularly Flipkart ki official website ya app par bhi check karte rahein.

Summary

Iss article mein humne Flipkart Loan apply karne ki puri jaankari di hai. Is article mein di gayi jaankari ko padhkar, koi bhi vyakti bahut hi aasani se Flipkart Loan Apply Kaise Kare, iske poore details ko prapt kar sakta hai. Ek sidha aur saral tareeke ke saath, Flipkart apne sabhi users ko ₹10,000 se lekar ₹5,00,000 se zyada tak ka personal loan lene ki suvidha deta hai. Poora online application process upar explain kiya gaya hai, aur ise padhkar aap application ke saare kadam samajh sakte hain.

Dosto, ummeed hai ki aap sabne is article ko ant tak padha hoga aur yeh aapko bahut pasand aaya hoga. Main aapko yeh protsahan deta hoon ki aap is article ko like, share, aur apne feedback ke liye comment karein.

Flipkart Loan Apply Kaise Kare:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

FAQ’s – Flipkart Loan Apply Kaise Kare

Sawal: Flipkart Loan kaise apply karein?

Jawab: Flipkart Loan ke liye apply karne ke liye, sabse pehle Flipkart app download karein. App mein login karein, ‘Financial Services’ ya ‘Loans’ section mein jaayein, wahaan se personal loan type chunein, required details bharein, documents upload karein, aur application submit karein.

Sawal: Flipkart Loan kitne time mein approve hota hai?

Jawab: Approval time har case mein alag hota hai. Kuch cases mein approval turant ho sakta hai, jabki kuch mein thoda samay lag sakta hai. Aap Flipkart app par ya unki website par regularly check karte rahein.

Sawal: Kitna loan amount mil sakta hai Flipkart Loan se?

Jawab: Flipkart Loan se aap ₹10,000 se lekar ₹5,00,000 ya usse bhi zyada tak ka personal loan prapt kar sakte hain, aapke eligibility ke hisab se.

Sawal: Flipkart Loan ke liye eligibility kya hai?

Jawab: Eligibility criteria alag-alag ho sakta hai, lekin aam taur par aapko Flipkart app par ya website par registration karna hoga, aur wahaan aapko unki di gayi guidelines follow karni hogi.

Sawal: Documents kiya kiya chahiye Flipkart Loan ke liye apply karte waqt?

Jawab: Documents ki requirement case to case alag hoti hai, lekin Aapko aksar identity proof, address proof, income proof, aur employment proof ki zarurat hoti hai. Flipkart app ya website par aapko ye details mil jayegi.