Google Pay Se Personal Loan Kaise Le:- Namaskaar doston agar aap bhi loan lene ke baare mein soch rahe hain aur bank ka chakkar kaatte kaatte aap bhi thak gaye hain to aap sabhi ko bata dete aaj ke is article ke maadhyam se aap sabhi ko personal loan ke baare mein jaankari diya gaya hai aur is jaankari ke maadhyam se aap keval kuchh hi minute mein aapko loan le sakte hain saathi aapko bata dein ,

ki bina kisi document ke aapko personal loan le paayenge aur aapko bank ka baar baar chakkar kaatna bhi nahi hoga aur aap online ke maadhyam se hi vyaktigat loan aap le sakte hain , Google Pay Se Personal Loan Kaise Le? ke baare mein agar aap bhi soch rahe hain to bas yeh article aap sabhi ke liye hain bas aap log is article ko ant tak zaroor padhein

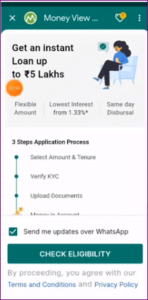

jaankari ke liye aap sabhi paathakon ko bata dein ki Google Pay Se Personal Loan Kaise Le ke baare mein soch rahe hain to bas aapke paas kuchh saadhaaran saa document hona chahiye jaise ki aap sabhi ko bata dein sabhi ke paas vartamaan samay mein aadhaar card hota hi hai aur iske baad aap sabhi ke paas pan card bhi hona chahiye aur pichhle 6 mahina tak ka bank statement bhi aapke paas hona chahiye uske baad aap google pay se aap personal loan le sakte hain

to doston aap sabhi google pay ke maadhyam se loan lene ke ichchhuk hain to aap sabhi is article ko zaroor padhein aur antatah is article mein aap sabhi ko personal loan lene ka quick link ke bhi diya gaya hai jahaan se aap log personal loan le paayenge

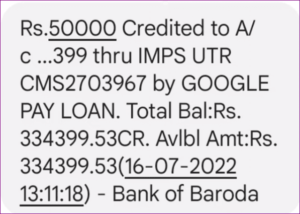

Google Pay se paayen haathon – haath ghar baithe personal loan, yeh hai pooree prakriya – Google Pay Se Personal Loan Kaise Le?

Google Pay Users ko aaj ke is article mein haardik haardik abhinandan hai aur aap jahaan ek taraf bank ka lagaataar chakkar kaat rahe the phir bhi aapko loan lene mein kathinaai ho rahi thi lekin aaj ke is article ke maadhyam se jo jaankari diya gaya hai is jaankari ke mutaabik aap log bina bhagdaud ke liye loan le paayenge Google Pay Se Personal Loan Kaise Le?

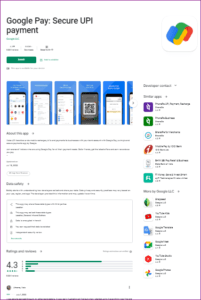

Google Pay Se Personal Loan agar aap lene ke baare mein soch rahe hain to aap sabhi ke mobile mein google pay: secure upi payment app hona chahiye aur aap bina kisi samasya ke aur bina bank ke chakkar kaate hue aur bina bhagdaud ka aap loan le paayenge loan lene ki pooree prakriya ko aapko pehle ek baar samajh lena hoga uske baad aapko bata dein yeh loan aap online ke maadhyam se hi le paayenge yaani ki aap ghar baithe hue aap is non ko le paayenge

aur aap apna zarooratmand kaamon ko is loan ke sahaayta se nipat aa sakte hain jahaan ek taraf pehle hum log bank ke chakkar kaatte kaatte thak jaate the lekin loan lene mein bahut bada kathinaai ka saamna karna padta tha lekin is digital yug ke maadhyam se hum log ab ghar baithe hi koi bhi kaam kar lete hain isi tarah se ab loan lena bhi asaan ban chuka hai am logon ke liye.

Google pay ke maadhyam se loan lene ki pooree prakriya ko neeche bataya gaya hai ki is prakriya ko aap sabhi paathakon ko apnaana hoga uske baad antatah jo link diya gaya hai us link ke maadhyam se aap ghar baithe online loan le paayenge Google Pay Se Personal Loan Kaise Le

Google Pay Se Personal Loan Kaise Le – Highlights

| Name of the App | Google Pay: Secure UPI payment |

| Name of the Article | Google Pay Se Personal Loan Kaise Le? |

| Type of Article | google pay loan offer 2022 |

| Subject of Article | Complete Process of Google Pay Se Loan Kaise Le? |

| Amount of Loan You Can Apply For? | ₹10,000 To 10 Lakh |

| Mode of Loan? | Instant |

Step By Step Online Process of Google Pay Se Personal Loan Kaise Le?

Google Pay ka App agar aap use karte hain to aapko bata dein ki aapko haathon haath personal loan le paayenge –

- Google Pay Se Personal Loan Kaise Le ke baare mein aap sochte hain to aapko bata dein ki aapke paas ek smartphone hona chahiye

- Google Pay: Secure UPI payment app ko download karna hoga jo ki aapko bata de neeche photo mein jis prakaar se bataya gaya hai –

- aap app ko download karne hain uske baad aap apne mobile mein is app ko install kar le

- pooree tarah se app install ho jaane ke baad aap sabhi ko neeche bataye gaye chitrn ke anusaar aapko yeh dekhne ko milegi –

- phir aap sabhi ko sabse pehle is app mein khud ka rajistreshan ek baar kar lena hoga |

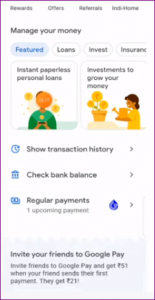

- ek baar aap rajistreshan kar lete hain uske baad aapko sabse pehle dashboard bhi aana hoga aur eskrol karke aap neeche aaenge jo ki is prakaar se dikhega –

ab aap sabhi ke mobile screen par Instant Paperless Personal Loan ka ek option dekhne ko mil jaayegi jahaan par aap logon ko click kar lena hoga jaise hi aap ek baar chalee ki kar

Google Pay Se Personal Loan:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Conclusion

Aaj ke is post ke maadhyam se aap sabhi google pay users ko personal loan yaani ki Google Pay Se Personal Loan ke baare mein sabhi jaankari ko bataya gaya hai taaki aap log loan le karke apna zarooratmand kaam ko poora kar sakenge saath hi Google Pay Se Personal Loan Kaise Le taaki aap sabhi aasaani se google pay se loan praapt kar sake aur iska laabh praapt kar saken. Google Pay Se Personal Loan Kaise Le

Kuchh to hum yeh aasha kar sakte hain ki yeh article aap sabhi ko bahut hi achha laga hoga aur is article ke sahaayta se aap log ko kuchh loan lene ke baare mein jaankari bhi mil gayi hogi aur ummeed karte hain aap loan le karke apne zarooratmand kaamon ko nahi pata sakte hain to is article ko aap logon jyaada se jyaada zaroor share karenge aur is article ko ant tak padhne ke liye dhanyavaad.

FAQS Google Pay Se Personal Loan Kaise Le

Google Pay ek digital payment platform hai jo Google ne develop kiya hai, aur yeh personal loan directly offer nahi karta hai. Lekin, Google Pay aapko aapke location aur eligibility ke aadhaar par personal loan providers ki jaankari aur options provide kar sakta hai. Yahaan kuchh frequently asked questions (FAQs) hain jo personal loans aur Google Pay se related hain:

Google Pay ke through main personal loan le sakta hoon?

Google Pay khud personal loan offer nahi karta hai. Lekin, yeh aapko personal loan providers ki jaankari aur suggestions provide kar sakta hai jo aap explore kar sakte hain.

Google Pay ke through main personal loan providers kaise dhoond sakta hoon?

Google Pay ke through personal loan providers dhoondne ke liye, aap yeh steps follow kar sakte hain:

a. Apne mobile device par Google Pay app ko open karein.

b. App mein “Explore” ya “Financial Services” section ko dekhein.

c. Us section mein, aapko various personal loan providers ki jaankari mil sakti hai.

d. Available options ko review karein aur ek provider choose karein jo aapke requirements ke hisaab se ho.

e. Instructions ko follow karein aur chosen provider ke saath directly loan ke liye apply karein.

Personal loan ke liye apply karne ke liye mujhe kya kya information provide karni hogi?

Personal loan ke liye apply karne ke liye, aapko typically yeh information provide karni hogi:

a. Personal details: Full name, date of birth, address, contact information.

b. Employment details: Current employment status, income details, employer information.

c. Financial details: Bank account information, any existing loans or debts.

d. Identification documents: PAN card, Aadhaar card, ya other relevant identification documents.

Google Pay personal loan applications mein kaise help karta hai?

Google Pay aapko ek platform provide kar sakta hai jahaan se aap personal loan options ko discover aur explore kar sakte hain. Yeh aapko aapke location aur eligibility criteria ke basis par loan providers ki ek list offer kar sakta hai. Lekin, actual loan application aur approval process typically loan provider ke dwara hi handle kiya jaata hai.

Google Pay ke through offer kiye gaye personal loans safe hain?

Google Pay financial transactions ke liye ek safe aur secure platform provide karne ka aim rakhta hai.

Lekin, yeh dhyaan rakhein ki personal loans third-party lenders dwara provide kiye jaate hain, aur unke safety aur terms alag-alag ho sakte hain. Yeh recommended hai ki loan application se pehle loan provider ki credibility ko thoroughly research aur verify karein.

Yaad rakhein, kisi bhi personal loan ka decision lene se pehle uske terms, interest rates, aur repayment conditions ko carefully evaluate karna advisable hai. Ek financial advisor se consult karna ya apna khud ka research karna consider karein taaki aap ek informed choice bana sakein.