Kotak Mahindra Bank Se Personal Loan Kaise Le:-Iss lekh mein hum Kotak Mahindra Bank se personal loan prapt karne ki prakriya ko explore karenge. Kotak Mahindra Bank ek utkrisht vittiy sanstha hai jo apne grahakon ko hamesha acchi seva pradan karti hai. Yeh Bharat mein pramukh bankon mein se ek hai aur vibhinn prakar ke nirakshar loan pradan karti hai.

Is lekh mein hum Kotak Mahindra Bank Se Personal Loan Kaise Le prapt karne ki vyapak jankari pradan karenge. Is lekh ko poora padhkar aap Kotak Mahindra Bank se personal loan prapt karne ki saral prakriya ko samajhenge.

Kotak Mahindra Bank Se Personal Loan Kaise Le prapt karne ke liye shuruat karne ke liye unke adhikarik website par jaaye ya apne nazdeeki shakha mein jaaye. Wahan aapko loan aavedan prakriya ko shuru karne ke liye saari avashyak jankari aur margdarshan milenge.

Personal loan ke liye aavedan karte samay, apne vittiy avashyaktaon aur samarthyaon ko dhyan mein rakhna mahatvapurna hai. Apne zarooraton ka mulyankan kare aur aapko kitna loan ki zaroorat hai, yeh tay kare. Isse aap apne bhugtan yojana ko yojana bana sakenge aur aapke liye vittiy managable loan ka lena hoga.

Agar aapko paise ki zaroorat hai aur apne zarooraton ko pura karna chahte hain, toh hamesha taiyaar rahein, kyunki Kotak Mahindra Bank aapki madad ke liye hamesha tayar hai. Kotak Mahindra Bank ke madhyam se aap kam dastavezon ke saath personal loan prapt kar sakte hain.

Is lekh mein hum Kotak Mahindra Bank Se Personal Loan Kaise Le prapt karne ki poori jankari pradan karenge. Is lekh ko padhkar aur samajhkar aap Kotak Mahindra Bank se personal loan ke liye aavedan kar sakte hain. Yeh aavedan online tareeke se ho sakta hai.

Table Of Contents Hide Kotak Mahindra Bank Se Personal Loan Kaise Le – Ek Nazar |

| Article Ka Name | Kotak Mahindra Bank Se Personal Loan Kaise Le |

| Article Ka Type | Other |

| Name of the Bank | Kotak Mahindra Bank |

| Apply Mode | Online |

| Age | 21 Year – 58 |

| Type of Loan | Personal Loan |

| Interest Rate | 10.99% |

| Credit Score | 650 Avobe |

| Monthley Income | 30,000 |

| Required Document | Aadhar, Pan , Photo Etc. |

| Loan Amount | ₹50000 Up to 40 Lac |

| Official Website | Click Here |

Kotak Mahindra Bank Se Personal Loan Kaise Le jane iske fayde

Kotak Mahindra Bank se personal loan lene ke kuch fayde hai, jo niche diye gaye hain:

- Aasan Aavedan Prakriya: Kotak Mahindra Bank personal loan ke liye aavedan prakriya ko saral banati hai. Aap online aavedan kar sakte hain aur kam dastavej ke saath loan prapt kar sakte hain.

- Pratishthit Bank: Kotak Mahindra Bank Bharat mein ek pramukh aur pratishthit bank hai. Unki sthayitvapurna upasthiti aur vishvasniya sevaon ke karan, aap unpar bharosa kar sakte hain.

- Nirakshar Loan: Kotak Mahindra Bank nirakshar loan pradan karti hai, jiske liye aapko kisi tarah ke jama karne ki zaroorat nahi hoti hai. Isse aap apni zarooraton ko pura karne ke liye loan prapt kar sakte hain.

- Samay Ki Bachat: Kotak Mahindra Bank ki aavedan prakriya saral aur tezi se hoti hai, jisse aapka samay bachta hai. Aap online aavedan karke apne ghar se hi loan prapt kar sakte hain.

- Niyamit Bhugtan Vyavastha: Kotak Mahindra Bank aapko niyamit bhugtan vyavastha pradan karti hai. Aap apne aavashyaktaon ke anuroop bhugtan yojna chun sakte hain aur apne loan ko samay par asani se chuka sakte hain.

- Pratishthit Sujhav: Kotak Mahindra Bank personal loan ke liye pratishthit sujhav pradan karti hai. Aap unke vittiy salahkaron se mil kar apne zarooraton ke anusar loan ki rashi aur bhugtan yojna ke baare mein salah prapt kar sakte hain.

Yeh the kuch fayde jo Kotak Mahindra Bank se personal loan lene mein hote hain. Loan ke liye aavedan karne se pahle, aapko apne zarooraton ko aur vittiy samarthya ko dhyan mein rakhna chahiye. Iske saath hi, Kotak Mahindra Bank ke loan ke niyam aur sharton ko bhi dhyan se padhna zaruri hai.

Kotak Mahindra Bank Personal Loan Ke Liye Intrest Rate

Kotak Mahindra Bank personal loan ke liye aapko uttariyak dar (interest rate) dena hoga. Interest rate aapke loan ke maanak sthapit kiye gaye dar ko darshata hai, jise aapko apne loan ke bharosey ke roop mein dena hoga.

Kotak Mahindra Bank ke personal loan ke interest rate pradhan roop se kuch factors par nirbhar karta hai, jaise aapke loan ki rashi, aavedan ki avadhi, aapki kredit itihas, aay, aur bank ke nirdharit niyam.

Interest rate ki vyaktigat jankari ke liye, aapko Kotak Mahindra Bank ke adhikari se sampark karna chahiye. Ve aapko current interest rate, loan ki vyaktigat sharton, aur anya mahatvapurna jankari pradan kar sakte hain. Aapko apne zarooraton, vittiy samarthya aur bank ke niyamon ke anuroop loan ke liye interest rate tay karna chahiye.

Yad rakhein ki interest rate sthapit daron mein parivartan ho sakta hai, isliye niyamit roop se bank ke saath sampark mein rahna zaruri hai. Aapko bank se prapt ki gayi vyaktigat jankari par adharit karke apna loan ke liye interest rate tay karna chahiye.

Sabhi banks Bharat mein, Kotak Mahindra Bank karz ke liye akarshak byaz dar pradan karta hai. Kotak Mahindra Bank ke personal loan byaz dar se sambandhit jankari niche di gayi hai. Nimn likhit vivaran ko padhkar aap aasani se samajh sakte hain Kotak Mahindra Bank ke personal loan byaz dar ko. Kotak Mahindra Bank dvara pradan kiye jane wale personal loan byaz dar nimn hai:

- Agar aap Kotak Mahindra Bank se ek loan lete hain, toh byaz dar 10.99% hai.

- Kotak Mahindra Bank ke personal loan ke liye up to 1% tak ek prakriya shulk hai.

- Kotak Mahindra Bank se prapt personal loan ki vapsi 5 varshon ke andar hoti hai.

- Kotak Mahindra Bank ke madhyam se personal loan prapt karne ke liye aapke paas kam se kam 650 ya usse adhik CIBIL score hona chahiye.

Kotak Mahindra Bank Se Personal Loan Kaise Le Important Documents ?

Kotak Mahindra Bank se personal loan lene ke liye nimn mahatvapurn dastavezon ki avashyakta hoti hai:

- Proof of Identity (Pehchan Praman Patra): Aapko apni pahchan ka saboot dena hoga. Iske liye aap kisi bhi sarkari ID jaise Passport, Aadhaar Card, Voter ID Card, Driving License, etc. ka istemal kar sakte hain.

- Proof of Address (Pata Praman Patra): Aapko apne nivas ka saboot dena hoga. Iske liye aap bijli ka bill, paani ka bill, telephone ka bill, bank passbook, voter ID card, ya kisi anya sarkari dastavej ka istemal kar sakte hain. Yeh dastavez aapke naam par hona chahiye aur aapke vartaman pate ka purn pata hona chahiye.

- Income Proof (Aay Ka Saboot): Aapko aapki aay ka saboot dena hoga. Agar aap salaried vyakti hain, toh aapko salary slips, form 16, ya apne employer dwara pradan kiye gaye anya dastavez dena hoga. Agar aap self-employed hain, toh aapko apni audited financial statements, income tax returns, ya kisi bhi anya aay se sambandhit dastavez ka istemal karna hoga.

- Employment Proof (Naukri Ka Saboot): Agar aap salaried vyakti hain, toh aapko apne current employer ka naam, pata aur sampark sankhya pradan karna hoga. Aapko apne job position aur pichhle naukriyon ke bare mein bhi jankari deni hogi. Agar aap self-employed hain, toh aapko apne business registration documents aur business continuity proof jaise GST registration certificate, shop establishment certificate, ya kisi anya sambandhit dastavez ki avashyakta hogi.

- Bank Statements (Bank Khate Ki Sthiti): Aapko apne pichhle 6 mahine ke bank khate ki pratidhvaniyan pradan karni hogi. Yeh dastavez aapki aarthik sthiti aur vyaktigat vittiya paristhiti ko samajhne mein madad karegi.

Iske alawa, dusre dastavez jaise photograph, loan application form, aur kisi bhi anya prasangik dastavez ki avashyakta bhi ho sakti hai, jo bank dvara niyamit kiya gaya ho.

Yadi aap Kotak Mahindra Bank se personal loan ke liye aavedan kar rahe hain, toh bank ki website par jaye ya bank ke branch mein sampark kare, jahan aapko puri jankari prapt hogi aur aapko sahi dastavezon ke bare mein suchit kiya jayega.

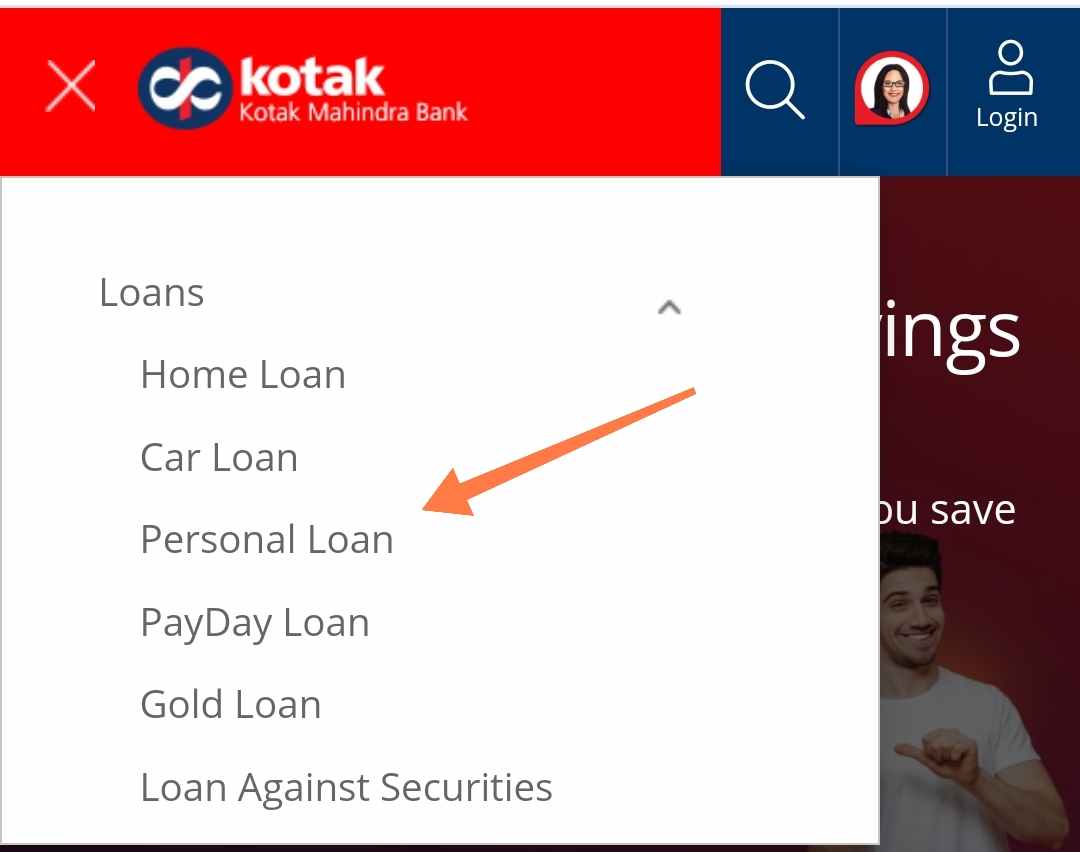

Quick And Easy Steps Online Apply Kotak Mahindra Bank Personal Loan

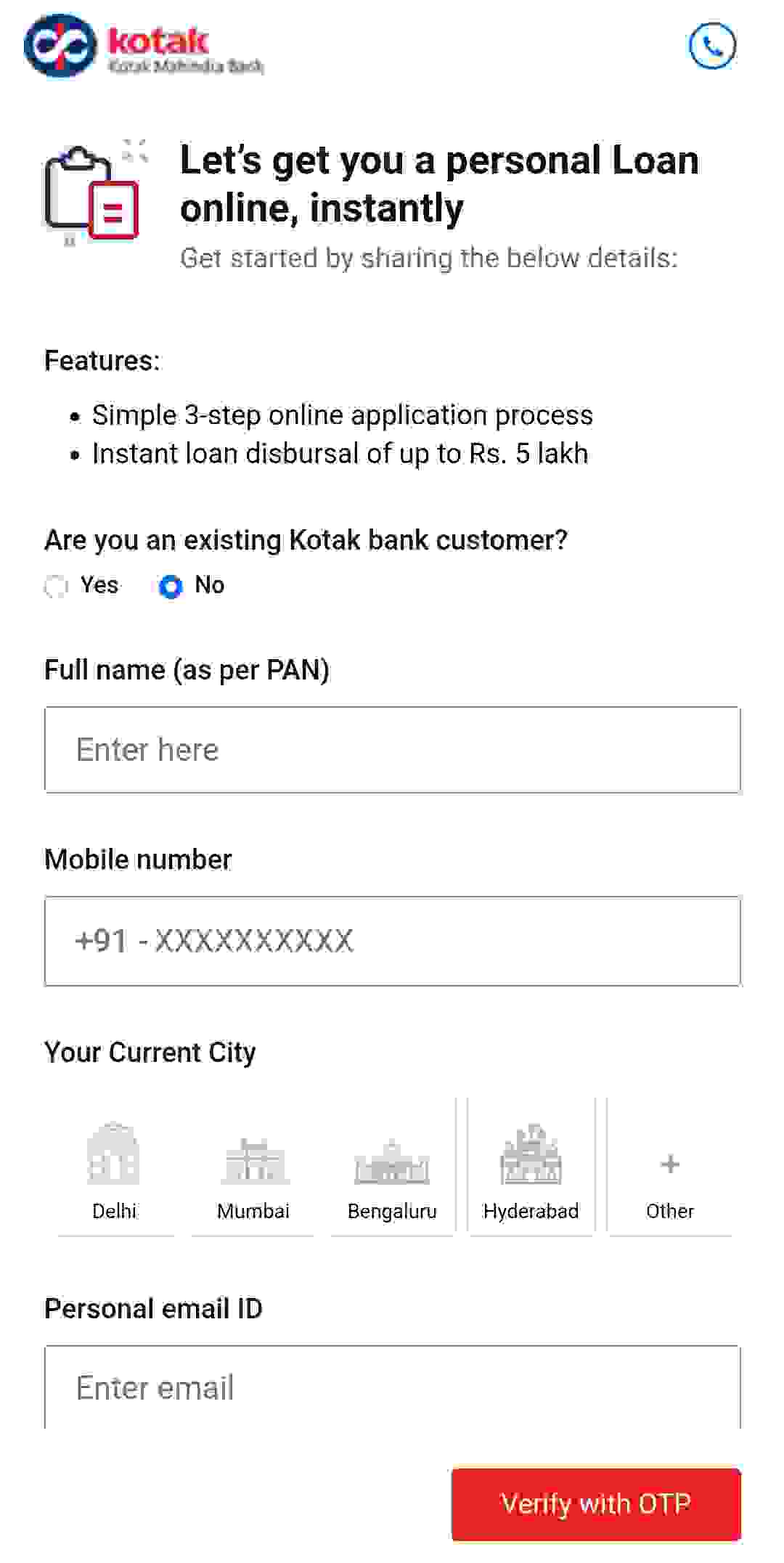

Kotak Mahindra Bank ke personal loan ke liye online aavedan karna bahut aasan hai. Neeche diye gaye kadamon ko follow karein:

- Kotak Mahindra Bank ki official website par jaayein. Wahan “Personal Loan” ya “Loans” jaisa section dhoondein.

- Personal Loan section mein jaa kar “Apply Now” ya “Online Application” jaisa button ya link dhoondein aur us par click karein.

- Aapko ek online application form prapt hoga. Is form ko dhyan se bharein aur sahi jankari pradan karein. Aapko personal details, employment details, income details, loan amount, aur loan tenure jaise maamle mein jankari deni hogi.

- Dastavezon ko upload karein: Aapko application form ke saath apne dastavezon ko scan karke upload karna hoga. Yeh dastavez aapke identity proof, address proof, income proof, aur anya avashyak dastavez honge. Kotak Mahindra Bank ke website par yeh dastavez upload karne ke liye specific instructions hongi.

- Application review karein: Jab aap application form aur dastavez upload kar denge, Kotak Mahindra Bank aapke aavedan ko samiksha karega. Ismein thoda samay lag sakta hai.

- Verification process: Bank aapki jankari aur dastavezon ki sahiyata ke liye verification process shuru karegi. Ismein aapke diye gaye phone number, email address aur anya communication channels ka upyog kiya jayega.

- Loan approval: Jab aapki aavedan ki sahiyata ho jaye aur aapki eligibility ko swikar kiya jaye, Kotak Mahindra Bank aapko loan approval ka sandesh dega. Yeh sandesh aapke registered email address aur phone number par prapt hoga.

- Loan disbursal: Jab aapko loan approval ka sandesh mil jaye, aapko Kotak Mahindra Bank ki taraf se loan rashi prapt hogi. Aapki bank account mein loan rashi bhej di jayegi.

Is tarah se aap Kotak Mahindra Bank ke personal loan ke liye online aavedan kar sakte hain. Dhyan rahein ki yeh sirf ek samanya prakriya hai aur bank ki niyamon aur sharton ka palan karna mahatvapurn hai. Aapko bank ki website par jaye aur sahi aur saksham suvidhaon ke sambandh mein jankari prapt karein.

Kotak Mahindra Bank Se Personal Loan Kaise Le:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Conclusion

Doston, humne aapko Kotak Mahindra Bank Se Personal Loan Kaise Le ek vistarik margdarshan pradan kiya hai. Vartaman mein, Kotak Mahindra Bank 50,000 rupaye se 40 lakh rupaye tak ke personal loans pradan kar raha hai. Agar aap Kotak Mahindra Bank ke madhyam se ek personal loan lena chahte hain, toh aapko online aavedan karna hoga. Is lekh mein humne step-by-step margdarshan pradan kiya hai ki Kotak Mahindra Bank se personal loan ke liye aavedan kaise karein, iska poori jankari aapko lekh ko ant tak padhkar prapt hogi.

Doston, ummeed hai ki aap sabne is lekh ko ant tak padha aur ise atyant upyogi paya. Agar aapko yeh lekh pasand aaya ho, toh us par like, share aur comment jarur karein.

FAQ’s – Kotak Mahindra Bank Se Personal Loan Kaise Le

Yahaan kuch aam sawaal-jawaab hai jo aapke man mein aa sakte hain Kotak Mahindra Bank se personal loan lene ke baare mein:

Q1. Kotak Mahindra Bank se personal loan lene ke liye kya yogyata maangte hain?

A1. Kotak Mahindra Bank personal loan ke liye aapki umar 21 saal ya usse adhik honi chahiye. Aapko sthir naukri ya vyavasaayik suraksha honi chahiye, aur aapki aay aavashyak star par honi chahiye.

Q2. Kotak Mahindra Bank personal loan ka aavedan kaise karte hain? A2. Kotak Mahindra Bank personal loan ke liye aap online aavedan kar sakte hain. Bank ki official website par jaayein, personal loan section mein jayein, aur wahan diye gaye instructions ke anusar aavedan form bharein aur dastavezon ko upload karein.

Q3. Kotak Mahindra Bank personal loan ke liye kitna samay lag sakta hai?

A3. Samay vyavastha bank ki taraf se nirbhar karti hai. Aapke aavedan ka samay pe samikshan aur aavashyak dastavezon ki satyapan karne mein samay lag sakta hai. Aam taur par, personal loan ki manjoori prapt karne mein kuch din tak ka samay lag sakta hai.

Q4. Kotak Mahindra Bank personal loan ki byaz dar kya hai?

A4. Kotak Mahindra Bank personal loan ki byaz dar aapki aay, kredit score, loan rakam aur anya aayojan par adharit hoti hai. Byaz dar badalte rah sakti hai, isliye bank ki website ya branch se abhi ki byaz dar ke baare mein jankari prapt karein.

Q5. Kotak Mahindra Bank personal loan ke liye kya dastavez zaruri hai?

A5. Kotak Mahindra Bank personal loan ke liye aapko aapki pahchan, pate ka saboot, aay ka saboot, naukri ka saboot, aur bank pratidhvaniyan jaise dastavezon ki avashyakta hogi. Aadhar, pan card, bank pratidhvaniyan, salary slips, IT return, aur anya dastavezon ki zarurat pad sakti hai.

Yeh kuch aam sawaal-jawaab the jo Kotak Mahindra Bank se personal loan lene ke baare mein ho sakte hain. Aapko bank se sahi jankari prapt karne ke liye unki official website ya branch se sampark karna chahiye.