PMEGP Loan Online Apply 2023:-Agar aapne sirf 8th class pass ki hai aur berojgar hain, toh sarkar aapko business shuru karne ke liye ₹50,000 se lekar ₹25 lakh tak ka loan de rahi hai. Agar aap sarkari loan ₹50,000 se ₹10,00,000 tak lena chahte hain, toh aap is article mein di gayi jaankari padhkar aasani se online apply kar sakte hain aur simple process se ₹25 lakh tak ka loan pa sakte hain. PMEGP Loan Online Apply 2023 ke liye kaise apply karein aur complete application process ki detailed jaankari is article mein share ki gayi hai.

Is article ko padhkar ab aap sarkar ke tahat PMEGP Loan Online Apply 2023 ka laabh utha sakte hain aur business shuru karne ke liye ₹50,000 se ₹25 lakh tak ka loan le sakte hain. Is loan ki khaas baat yeh hai ki applicants ko 15% se 35% tak ka subsidy amount bhi diya jaata hai. Hum sabhi berojgar yuvaon ko yeh bataana chahte hain ki aap sarkar se business shuru karne ke liye loan le sakte hain, jiske liye aapko online apply karna hoga.

Is yojana ke tahat ₹50,000 se ₹25 lakh tak ka loan uthaane ke liye, aapko kisi aur sarkari loan scheme ya sarkari program ka laabhdaar na hona chahiye. Saath hi, aapke parivaar mein kisi ko bhi sarkari naukri nahi honi chahiye. Agar aapke parivaar mein kisi ko bhi sarkari naukri hai, toh aap is loan ke liye eligible nahi honge. Article mein di gayi jaankari padhkar, aap bahut hi simple process se PMEGP Loan Online Apply 2023 ke liye apply kar sakte hain.

PMEGP Loan Online Apply 2023 – Highlights |

| Name Of Article | PMEGP Loan Online Apply 2023 |

| Type of Article | Sarkari Yojana |

| Bank Name | India Post Payment Bank |

| Who Can Apply? | All India Applicants Can Apply |

| Loan Apply Mode | Online |

| All Info. | Please Read The Article Completely |

| Loan Amount? | ₹50 Thousand Up to ₹25 Lakh |

| Required Minimum Age Limit? | 18 Years |

| Project Subsidy | 15% to 35% |

| Minimum Qualification? | 8th Passed Only |

| Official Website | Click Here |

Sarkar Se Aise Le ₹25 Lakh Tak Ka Loan,Buisness Start Karne Ke Liye – PMEGP Loan Online Apply 2023

Is article mein hum sabhi pyaare readers aur yuva logon ko dil se badhaai dena chahte hain. Sarkar desh ke sabhi berojgar yuvaon ko self-employment ventures shuru karne ke liye ₹25 lakh tak ka loan de rahi hai. Agar aap bhi apna business shuru karne ke liye Bharat sarkar se ₹25 lakh tak ka loan lena chahte hain, toh aapko online apply karna hoga. Yeh loan sarkar dwara shuru ki gayi PMEGP Loan Online Apply 2023 program ke tahat diya ja raha hai.

Aapko jaankari ke liye bata dein ki is loan ko paane ke liye, aapko Aadhaar card, PAN card, bank account passbook, project report, mobile number, email ID, passport-sized photographs aur anya zaroori jaankari jaise documents dena hoga. In details ko dene ke baad hi aap apna application submit kar payenge. PMEGP Loan Online Apply 2023 ke liye kaise apply karein ki poori jaankari is article mein share ki gayi hai, jisse aapko poora process samajh mein aa jayega. PMEGP Loan un berojgar yuvaon ko desh bhar mein diya ja raha hai jo apna venture shuru karne ke liye zaroori funds ki kami se guzar rahe hain.

Documents Required PMEGP Loan Online Apply 2023

PMEGP (Prime Minister’s Employment Generation Programme) loan online 2023 mein apply karne ke liye zaroori documents authorities dwara nirdhaarit guidelines aur requirements ke aadhaar par alag-alag ho sakte hain. Lekin yeh kuch aam taur par maange jaane waale documents hain jo aapko dena pad sakta hai:

- Identity Proof: Aadhaar Card, Voter ID card, Passport, ya koi aur sarkar dwara jaari kiya gaya identity proof.

- Address Proof: Aadhaar Card, Voter ID card, Passport, ya koi aur sarkar dwara jaari kiya gaya address proof jo aapka current residential address bataaye.

- Educational Qualification Certificate: Project ki nature ke hisaab se, aapko apna educational qualification certificate submit karna pad sakta hai jo aapki eligibility ko validate kare.

- Caste Certificate: Agar aap kisi specific caste category se hain aur uske saath judi benefits ya reservations ka laabh uthaana chahte hain, toh aapko ek valid caste certificate dena padega.

- Project Report: Ek detailed project report jo aapke business idea, market analysis, financial projections aur anya relevant jaankari ko outline kare.

- Income Certificates: Aise documents jaise income tax returns, salary slips, bank statements, ya koi aur evidence of your income jo aapki financial status ko establish kare.

- Business Plan: Ek comprehensive business plan jo aapke proposed venture ke operational aspects, marketing strategy aur financial projections ko detail mein bataaye.

- Partnership Deed or Memorandum of Association (agar applicable hai): Agar aapka business partnership ya registered company se involve hai, toh aapko partnership deed ya memorandum of association dena padega.

- Bank Account Details: Aapke bank account details, jismein account number aur IFSC code shaamil ho, jahaan loan amount disburse kiya jayega.

- Other Documents: Aise documents jo aapke project se specific ho ya PMEGP authorities dwara maange jaayein. Yeh licenses, permits, NOC (No Objection Certificate), etc., ho sakte hain.

Simple And Quick Step PMEGP Loan Online Apply 2023?

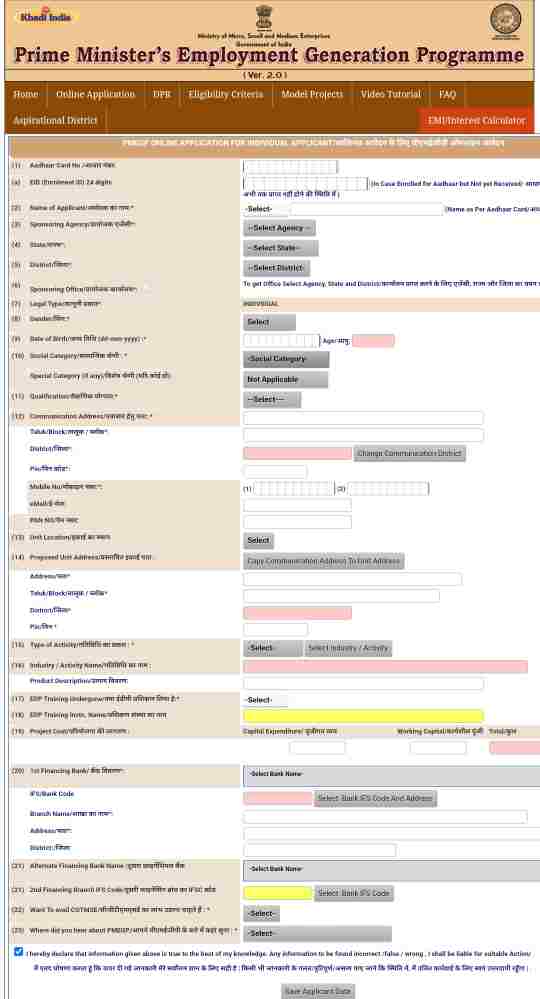

PMEGP (Prime Minister’s Employment Generation Programme) loan online 2023 mein apply karne ke liye, aap yeh steps follow kar sakte hain:

- Official PMEGP website par jaayein: PMEGP ki official website www.kviconline.gov.in/pmegp/ par jaayein.

- Registration: Agar aap naye user hain, toh aapko website par register karna hoga. “Online Application” tab par click karein aur “New Entrepreneur Registration” chunein. Apni zaroori details jaise naam, pata, contact information, etc., bharkein aur ek username aur password banayein.

- Login: Jab aap register ho jaayein, toh apne account mein diye gaye username aur password se login karein.

- Online Application Form: Login karne ke baad, aapko online application form bharne ka option milega. Us par click karke application process shuru karein.

- Application Form bharkein: Online application form mein saari zaroori jaankari bharkein, jaise personal details, project details, financial requirements, etc. Dhyaan rakhein ki aap form ko sahi aur poora bharkein.

- Documents upload karein: Aapko apne application ko support karne ke liye kai documents upload karne honge. Yeh documents identification proof, address proof, project report, income certificates, caste certificates (agar applicable hai), aur anya relevant documents ho sakte hain. Dhyaan rakhein ki aap documents ko scan ya upload karte samay clear copies de aur specified file size aur format ka palan karein.

- Application submit karein: Jab aap application form bharkein aur zaroori documents upload kar lein, toh di gayi jaankari ko sahi hone ke liye check karein. Sab kuch verify karne ke baad, application form online submit karein.

- Application Fee Payment: Application fee website par bataye gaye hisaab se pay karein. Fee online available payment options se pay ki ja sakti hai.

- Application Tracking: Apna application submit karne ke baad, aapko ek acknowledgment ya reference number milega. Is number se aap apne application ki progress online track kar sakte hain.

- Follow-up: PMEGP authorities se apne application ke baare mein koi notifications ya updates ka track rakhein. Agar aap se koi additional information ya documents maange jaate hain, toh jaldi se respond karein.

PMEGP Loan Online Apply 2023:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Conclusion

Is article mein humne PMEGP Loan Online Apply 2023 ke liye online application process ke baare mein vistar se jaankari share ki hai. Ab, desh bhar ke berojgar yuvaon ko apne business shuru karne ke liye Bharat sarkar se ₹50,000 se lekar ₹25 lakh tak ka PMEGP Loan mil sakta hai. PMEGP Loan Online Apply 2023 ke liye apply karne ke liye, aapko zaroori documents dena bahut zaroori hai. Uske baad, aap apna application online ghar baithe aasani se submit kar sakte hain.

Doston, mujhe umeed hai ki aap sabhi ne yeh article ant tak padha hai aur isse bahut hi informative aur enjoyable paya hoga. Hum aapki yadi aap is article ko like, share aur comment karein toh hume bahut khushi hogi.

FAQ’s – PMEGP Loan Online Apply 2023

Q1: PMEGP kya hai?

A1: PMEGP ka matlab hai Prime Minister’s Employment Generation Programme. Yeh ek sarkari yojana hai jo self-employment opportunities ko badhaane ke liye start-ups aur micro-enterprises ko financial assistance pradaan karti hai.

Q2: PMEGP loan ke liye kaun eligible hai?

A2: 18 saal se upar ke vyakti jo program guidelines dwara nirdhaarit minimum educational qualifications rakhte hain, wo eligible hain. Saath hi, yeh scheme women, scheduled castes/scheduled tribes, ex-servicemen aur differently-abled individuals ko priority deti hai.

Q3: Main 2023 mein PMEGP loan online kaise apply kar sakta hoon?

A3: 2023 mein PMEGP loan online apply karne ke liye, aap official PMEGP website par jaakar online application process follow kar sakte hain. Ek account banayein, application form bharkein, zaroori documents upload karein aur application online submit karein.

Q4: PMEGP ke tahat loan amount kitna available hai?

A4: PMEGP ke tahat loan amount project ki nature aur applicant ki category ke aadhaar par alag-alag hota hai. Loan amount kuch lakhs se lekar kai lakhs tak ho sakta hai, jo project ki viability aur applicant ki requirements par nirbhar karta hai.

Q5: PMEGP loans ka interest rate aur repayment period kya hai?

A5: PMEGP loans ka interest rate generally commercial loans se kam hota hai. Repayment period alag-alag ho sakta hai, lekin yeh aam taur par 3 se 7 saal tak ka hota hai, jo loan amount aur project ki nature par nirbhar karta hai.

Q6: PMEGP loans mein subsidy component kya hai?

A6: PMEGP loans mein subsidy component hota hai, jisme loan amount ka ek hissa subsidy ke roop mein diya jaata hai. Subsidy percentage project category aur applicant ki category (general category, special category, etc.) par nirbhar karta hai.

Q7: PMEGP loan ke online application ke liye kaun se documents zaroori hain?

A7: PMEGP loan ke online application ke liye zaroori documents mein identity proof, address proof, educational qualification certificate, project report, income certificates, business plan, bank account details aur anya documents shaamil ho sakte hain jo project se specific ho ya program guidelines ke anusaar ho.

Q8: PMEGP loan application ko process karne mein kitna samay lagta hai?

A8: PMEGP loan applications ko process karne mein samay alag-alag lag sakta hai. Yeh kuch hafton se mahinon tak lag sakta hai, jo factors jaise application ki completeness, verification process aur implementing agencies ka workload par nirbhar karta hai.

Q9: Kya main existing business ke liye PMEGP loan apply kar sakta hoon?

A9: PMEGP loans mukhya roop se naye ventures ke liye hain. Lekin kuch cases mein existing business ka expansion ya diversification loan ke liye eligible ho sakta hai, kuch conditions ke saath.

Q10: Main 2023 mein PMEGP loan application ke baare mein aur jaankari kahaan se prapt kar sakta hoon?

A10: 2023 mein PMEGP loan application ke baare mein aur jaankari prapt karne ke liye, hum aapko official PMEGP website par jaane aur wahaan di gayi latest guidelines, FAQs aur instructions ko refer karne ki salaah dete hain. Aap implementing agencies ya designated banks se bhi further assistance le sakte hain.