SBI E Mudra Loan Apply Online 2023:-Agar kisi mein se koi vyakti apna vyavsa shuru karna chahta hai ya apne pahle se sthapit vyavsa ko badhana chahta hai, toh kabhi-kabhi ye saare yojnayein arthik rukavat ke chalte tham jaati hain. Naukri se judi samasyaon ka samadhan karne ke liye, kendriya sarkar ne haal hi mein ek mahatvapurn kadam uthaya hai. Khud ko rozgarit karne ki pragati ko badhava dene aur logo ko berozgari ki samasya se rahat dilane ke liye,

kendriya sarkar ne sabhi niji aur kendriya bankon se anurodh kiya hai ki ve arthik sahayata pradan karen un logon ko, jo is avashyakata mein hain. Is prakar, State Bank of India (SBI) ne e-Mudra loan suvidha ko prastut kiya hai.

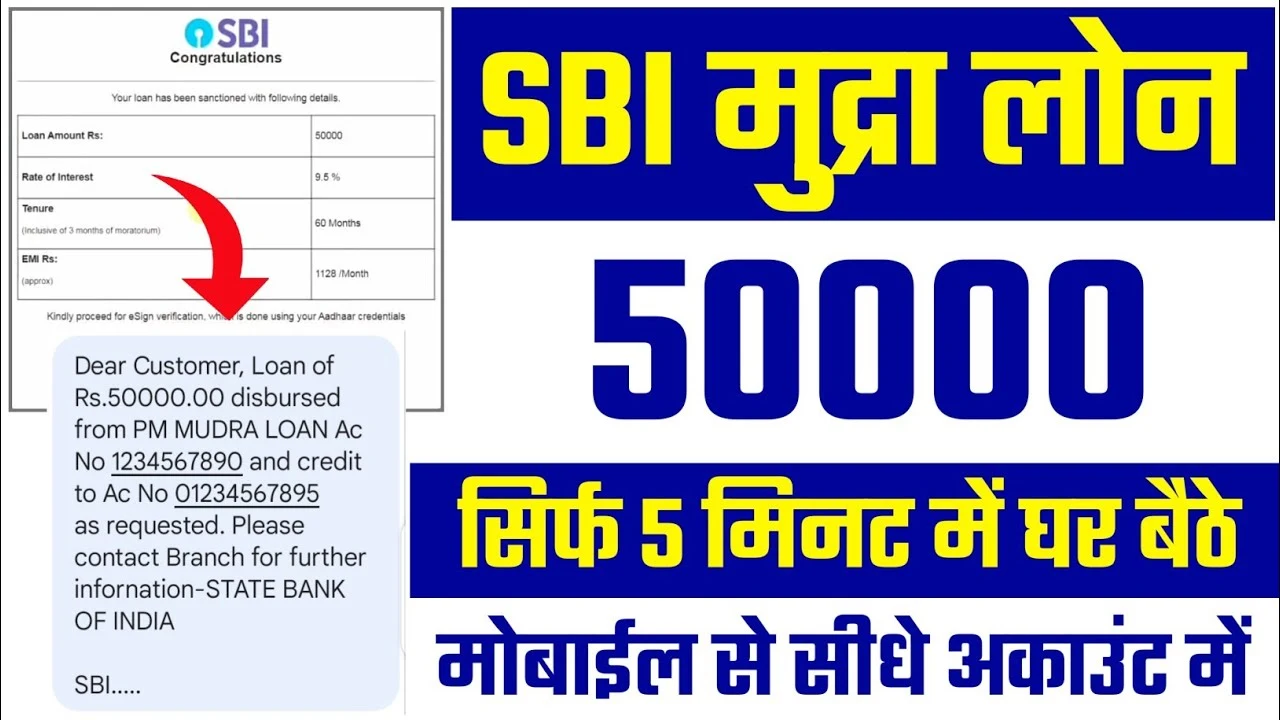

SBI E Mudra Loan Apply Online 2023 Mahatvapurn hai ki is yojna ke tahat lagbhag sabhi niji aur kendriya bank nagriko ko Mudra loan pradan karte hain, jisse vyakti apna khud ka vyavsa shuru kar sakein. SBI e-Mudra loan yojna ke tahat nagriko ko ₹1,000,000 tak ka loan prapt karne ki suvidha di jaati hai. SBI Bank ne apne upbhokta nagriko ko is yojna ke hisse ke roop mein Mudra loan uplabdh karane ka faisla liya hai.

SBI E Mudra Loan Apply Online 2023 – Overview

| Name Of Article | SBI E Mudra Loan Apply Online 2023 |

| Scheme | SBI e Mudra Loan |

| Bank Name | State bank of india |

| Objective | Promotion of self employment |

| Eligible | All Indian Citizens |

| Interest Rate | 9% To 12% |

| Official Website | Sbi.co.in |

SBI E Mudra Loan Apply Online 2023

Ham aapko suchit karna chahte hain ki kendriya sarkar dvara shuru kiye gaye Mudra Loan karyakram ke antargat State Bank of India (SBI) ne 2023 mein apne upbhoktaon ke liye ek Mudra Loan karyakram ko shuru kiya hai.

SBI e-Mudra Loan Yojna 2023 ke hisse ke roop mein SBI apne upbhoktaon ko ₹10 lakh tak ke loan pradan kar raha hai. Yah loan chote aur madhyam vyavsayon ko badhava dene ke liye hai.

Aapke jaankari ke liye, yah online SBI loan bahut kam byaz dar aur aasaan kishton mein uplabdh hai. Agar aap ek vyavsayi hain ya apna khud ka vyavsay shuru karna chahte hain, to aap SBI Bank e-Mudra Loan 2023 ke liye aavedan kar sakte hain aur loan prapt kar sakte hain.

Is worth mentioning ki State Bank of India ne 2015 mein kendriya sarkar ke adesh ke tahat e-Mudra Loan karyakram ko prastut kiya tha. Yah loan yojna chhote aur madhyam vyavsayon ko arthik sahayata pradan karne ke liye shuru ki gayi thi.

Is yojna ke tahat aavedak ₹50,000 se ₹10 lakh tak ke loan ka labh utha sakte hain, jiska punarnay anupat 60 mahine tak hota hai. Is loan ke byaz dar lagbhag 9% se 12% tak hoti hai. Isi ke saath, SBI mahilaaon ko e-Mudra SBI loan pradan karne mein vishesh prayas kar raha hai, jisse ve apna khud ka vyavsay shuru kar saken.

What are the documents required for taking E Mudra loan?

E-Mudra Loan lene ke liye nimnlikhit dastavez ki avashyakta hoti hai:

1. Aavedan Patra: Loan ke liye aavedan patra bharna hoga, jo bank dwara diye gaye praroop ya online platform par uplabdh hota hai.

2. Aadhar Card: Aapka Aadhar Card pramukh pahchan patra ke roop mein kaam karta hai. Aadhar Card ka praman karne ke liye xerox ya self-attested pratiyogita lagayein.

3. Business Plan: Vyavsayik Yojana (Business Plan) ek mahatvapurna dastavez hai. Yah dikhata hai ki aapka vyavsay kis prakar se chalne wala hai, kaise viksit hoga aur aap kaise byaj ka bhugtan karne wale hain.

4. Business Address Proof: Vyavsay ki patta pramanit karne ke liye aapko business address ka pramanik dastavez dena hoga. Aap light bill, pani bill, kirana dukan ke chalne wale pramanpatra adi ka upayog kar sakte hain.

5. Identity Proof: Aapka pahchan pramanit karne ke liye yadi passport, voter ID, ya kisi anya sarkari ID ka upayog karte hain, to uska praman patra dena hoga.

6. Bank Statement: Aapke vyavsay ke akhate ki nakal dena hoga, jo aapke vyavsayik uttaradayitva ka praman karti hai.

7. Income Proof: Aapka aay praman karne ke liye kuchh dastavez bhi diye jate hain. Jaise ki aapki vyavsayik return nakal, IT Return, ya aapke bank statement mein aay darshan hoti hai.

8. Category Proof (if applicable): Agar aap kisi reserved category mein aate hain, to aapko uska praman patra bhi dena hoga.

9. Photographs: Aapke aap ke ya vyavsay se jude kuchh tasveerein bhi deni hoti hain.

10. Other Relevant Documents: Aapke vyavsay ke prakar aur loan ke uddeshya ke anusar anya avashyak dastavez bhi diye ja sakte hain.

Yadi aap e-Mudra Loan ke liye aavedan kar rahe hain, to aap apne bank ya financial institution se sahi aur samay par jankari prapt karein, kyunki dastavezon ki yathasamay avashyakta hoti hai aur ye alag-alag bankon mein alag-alag ho sakti hain.

The Pradhan Mantri e-Mudra Loan scheme comes in how many types? Kitne Tarah Ke Hote Hai

Pradhan Mantri e-Mudra Loan Yojana do prakar ke mudde par kendrit hoti hai:

1. Shishu: Is prakar ke mudde mein, lagbhag ₹50,000 tak ka loan pradan kiya jata hai. Yeh madhyam aadhunik vyavsayik avastha mein shuruaat karne wale vyavsayikon ke liye upyukt hota hai. Shishu mudde mein byaj dar sabse kam hoti hai.

2. Kishor: Is prakar ke mudde mein, ₹50,000 se ₹5,00,000 tak ka loan pradan kiya jata hai. Yeh vyavsayik pragati ke liye madhyam mukhya mudde wale vyavsayikon ke liye upyukt hota hai.

3. Tarun: Is prakar ke mudde mein, ₹5,00,000 se ₹10,00,000 tak ka loan pradan kiya jata hai. Yeh adhunik vyavsayik sthitiyon mein pragati karne wale vyavsayikon ke liye upyukt hota hai.

In teen prakar ke mudde ko Pradhan Mantri e-Mudra Loan Yojana ke antargat pradan kiya jata hai, jisse ki alag-alag vyavsayik aavashyaktaon ko dhyan mein rakhte huye karz pradan kiya ja sake. Aapko apne vyavsayik uddeshyon aur avashyaktaon ke anusar sahi prakar ke mudde ka chayan karna chahiye.

SBI E Mudra Loan Eligibilty Kya Hona Chahiye

State Bank of India (SBI) ke e-Mudra Loan ke liye yeh mukhya yogyataen hoti hain:

1. Vyavsayik Uddeshya: Aapko e-Mudra Loan ke liye aavedan karte samay vyavsayik uddeshya batana hota hai. Aapke dvara chuna gaya vyavsayik uddeshya e-Mudra Loan ke antargat hona chahiye.

2. Vyavsayik Prakar: Aapke dvara chalaye ja rahe vyavsayik prakar ko bhi vyavsayik uddeshya ke sath sajha karna hota hai. Vyavsayik prakar ko spasht roop se bataiye.

3. Udghatan Samay: Vyavsayik udghatan ka samay aur prakriya bhi batani hoti hai. Aapko yeh dikhana chahiye ki aapke paas vyavsay chalu karne ki taiyari hai.

4. Karz Bhugtan Ki Samarthya: Aapke paas vyavsay chalane ke liye karz bhugtan ki samarthya honi chahiye. Aapko yeh dikhana hoga ki aap karz ko samay par bhugat sakte hain.

5. Vyavsay Ki Sankhya: Aapke vyavsay mein rojgar ke avasar ko darshane ke liye aapke vyavsay mein kitne log kaam karte hain, yeh bhi batana hota hai.

6. Karz Ki Matra: Aap kitni matra mein karz ki avashyakta hai, yeh bhi saaf taur par bataiye.

7. Purani Loan Ki Jankari: Agar aapke paas pehle se hi koi karz hai, to uske bare mein bhi jankari pradan karni hoti hai.

8. Udghatan Samagri: Aapko yeh dikhana chahiye ki aapke paas vyavsay chalane ke liye avashyak samagri aur sadhan upalabdh hain.

Yadi aap in yogyataon ko poora karte hain, to aap SBI e-Mudra Loan ke liye yogy ho sakte hain. Lekin yeh yogyataen bank ki neeti aur niyam ke anusar badal sakti hain, isliye SBI ke adhikarik website ya branch se jankari prapt kar len.

How To SBI E Mudra Loan Apply Online 2023

Agar aap SBI Mudra Loan ke liye online aavedan karna chahte hain, to humne aapke liye seedha link table pradan kiya hai. Halaanki, hum aapko poora prakriya bhi samjhane mein sahayata dena chahte hain, jo nimnlikhit hai:

- State Bank of India (SBI) ki adhikarik website par jaaye.

- Loan vibhaag par click karein.

- Loan vibhaag ke andar, aapko Mudra Loan ke liye link mil jayega.

- Us link par click karein.

- Fir, “SBI Loan Apply Now” vikalp par click karein.

- Yeh aapko SBI e-Mudra Loan aavedan prapatra tak le jayega.

- Savdhaanee se aavedan prapatra ko bharein, avashyak dastavez ko sken aur jod dein.

- Loan raashi ki jaankari bharein aur EMI vikalp chunein.

- Sari aavashyak jaankari pradan karne ke baad, “Submit” button par click karein.

- Aapka aavedan is tarah poora ho jayega. State Bank of India ke karmachaari aapke aavedan ko satyapan karenge, aur agar satyapan safalta purvak ho jata hai, to aapka SBI loan bank dvaara maanyata prapt karega.

Is prakar aap SBI Mudra Loan ke liye aavedan prakriya ko poora kar sakte hain.

SBI E Mudra Loan Apply Online 2023:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

FAQS SBI E Mudra Loan Apply Online 2023

Prashna: SBI e-Mudra Loan kya hai?

Uttar: SBI e-Mudra Loan ek prakar ka loan hai jo State Bank of India (SBI) dwara pradan kiya jata hai. Is loan ke madhyam se chhote aur madhyam vyavasaayiyon ko arthik madad pradaan ki jati hai.

Prashna: SBI e-Mudra Loan ke liye yogyata kya hai?

Uttar: SBI e-Mudra Loan ke liye yogyata ke liye vyakti ka Bharatiya nagrik hona chahiye, vyapar ya udyog chalane ki ichchha honi chahiye, aur vyapar ya udyog ke liye avashyak dastavez tatha pramanpatra upalabdh hona chahiye.

Prashna: Kya e-Mudra Loan online aavedan kaise kiya jata hai?

Uttar: SBI e-Mudra Loan ke liye online aavedan karne ke liye, State Bank of India ki adhikarik website par jaayein, loan vibhaag mein jayein, Mudra Loan link par click karein, aur “SBI Loan Apply Now” par click karke aavedan prapatra bharein.

Prashna: Loan ki maanak avadhi kya hai?

Uttar: SBI e-Mudra Loan ke liye maanak avadhi 5 se 7 varsh hai, jisse aap chayan kar sakte hain.

Prashna: Kya mujhe kisi prakar ke dastavez aur pramanpatra ki avashyakta hai?

Uttar: Haan, aapko vyavasaay ya udyog sambandhi dastavez, aay pramanpatra, udhar patra, aadhar card, vyavasaayik vitt varshik patra, aur anya aavashyak dastavez pradan karne ki avashyakta hoti hai.

Prashna: Kya mujhe loan ke liye kisi prakar ke jama karne ki avashyakta hai?

Uttar: Haan, loan ke liye aapko pradhanamantri Mudra Yojana ke anusaar kisi prakar ke jama ya rakhav paatr hone ki avashyakta hoti hai.

Prashna: SBI e-Mudra Loan ke liye bharat mein kitni shreniyan hoti hain?

Uttar: SBI e-Mudra Loan ke liye teen prakar ki shreniyan hoti hain: Shishu, Kishor, aur Tarun.

Prashna: Kya mujhe bina bank branch jaaye hi loan ke liye aavedan karne ka vikalp hai?

Uttar: Haan, aap SBI e-Mudra Loan ke liye online aavedan kar sakte hain, isse aapko bank branch jaane ki avashyakta nahi hoti.

Prashna: Kya e-Mudra Loan ke liye kisi prakar ki processing fees lagti hai?

Uttar: Nahi, SBI e-Mudra Loan ke liye kisi bhi prakar ki processing fees nahi lagti hai.

Prashna: Kya SBI e-Mudra Loan online aavedan karne ke liye direct link upalabdh hai?

Uttar: Haan, aapko SBI e-Mudra Loan ke liye online aavedan karne ke liye adhikarik website par direct link pradan kiya gaya hai.

Prashna: Kya mujhe SBI e-Mudra Loan ke liye kisi tarah ke pramanpatra dene ki avashyakta hoti hai?

Uttar: Haan, aapko vyavasaayik vitt varshik patra, aay pramanpatra, vyavasaay ya udyog sambandhi dastavez, aur udhar patra pradan karne ki avashyakta hoti hai.

Is prakar se aksar puche jane wale sawalon ke uttar SBI e-Mudra Loan online 2023 ke bare mein jankari pradan karte hain.