Kisan Credit Card Online Apply 2023:-Agar aapki kheti aur krishi ki maang poori karne mein dhan ki kami hai aur aapka fasal barbaad ho raha hai jabki aap karz mein dubte ja rahe hai, toh yeh lekh aapke liye bahut faydemand ho sakta hai. Iss lekh mein, hum aapko Kisan Credit Card Online Apply 2023 ke baare mein vistaar se jaankari denge.

Hum aapko yeh bhi bataayenge ki Kisan Credit Card ke liye aavashyak dastaavej ki suchi kya hai, chahe aap ise online ya offline mode ke madhyam se apply karna chahte ho. Iss se aap aasani se in dastaavejon ko taiyaar karke Kisan Credit Card ke liye apply kar sakte ho aur uske fayde utha sakte ho.

Kripya dhyaan dein ki Kisan Credit Card yojna bharat ki ek vishesh yojna hai jiska uddeshya kisaanon ko unke krishi ki aavashyaktaon ke liye hamaare desh mein shulk sasta karke karz pradaan karna hai.

Kisan Credit Card Online Apply 2023 – Qucik Details

| Article Ka Name | Kisan Credit Card Online Apply 2023 |

| Card Ka Name | Kisan Credit Card |

| Type of Article | Latest Update |

| Kaun Apply Karenge? | All India Farmers Can Apply. |

| Mode of Application | Offline |

| Amount of Loan Can We Taken On KCC? | ₹3 Lakh Rs. |

| Interest Rate | 7% |

| Contact To | Your Nearest Bank Branch |

KCC Card Ki Help Se Pure 3 Lakh Ka Loan Le, Ghar Baithe Kare Apply – Kisan Credit Card Online Apply 2023?

Hamare saare kisan bhaiyon ko garmi se bahut bahut swagat hai jo apne krishi ki jarooraton ko poora karne ke liye karz lena chahte hain. Iss lekh mein, hum aapko Kisan Credit Card Online Apply 2023 ke baare mein vistaar se jaankari denge.

Hum samajhte hain ki aap Kisan Credit Card ke fayde uthana chahte hain, isliye hum aapko online aur offline dono tarike se Kisan Credit Card ke liye aavedan karne ka tareeka batayenge.

Iss lekh ke ant mein, hum aapko tezi se aage badhne wale Kisan Credit Card se sambandhit najarein pradan karte hain, taaki aap aasaani se sabse latest lekhon tak pahunch sakein aur har waqt updated rah sakein.

Kripya dhyaan dein ki Kisan Credit Card yojna bharat ki ek vishesh yojna hai jiska uddeshya kisaanon ko unke krishi ki aavashyaktaon ke liye hamaare desh mein shulk sasta karke karz pradaan karna hai.

Kisan Credit Card Online Apply 2023 – Jaruri Labh Aur Fayde?

Kisan Credit Card Online Apply 2023 se judi Kisan Credit Card (KCC) yojna kai fayde aur labh pradaan karti hai kisaan bhaiyon ko. Yahan kuch mukhya fayde hain Kisan Credit Card Online Apply 2023 ke:

Karz Ki Pahunch: KCC yojna ke antargat, kisaan apne krishi ki avashyaktaon ko poora karne ke liye 3 lakh tak ka bank karz prapt kar sakte hain. Yah karz fasal ki kheti, kheti ki raksha, beej aur urvarak kharid, pashupalan aur machhli palan adi ke liye prayog kiya ja sakta hai.

Samay par aur Sastey Karz ki Pahunch: KCC kisaanon ko unke krishi karyon ke liye samay par aur saste karz ki pahunch pradaan karti hai, jaise fasal utpaadan, fasal ke baad ke kharche, kheti ki raksha, aur marketing kary.

Lacheela Bhugtan Vikaas: Kisan Credit Card yojna ke antargat kisaan lacheele bhugtan vikalpon ka labh utha sakte hain. Ve apane karz ko fasal ki utpaadan aur krishi se aay prapt hone par bhugtan kar sakte hain.

Saral Dastavezikaran: Kisan Credit Card karz prapt karne ke liye dastavezikaran prakriya ko saral banata hai, jisse kisaan aavedan karne aur karz prapt karne mein aasani hoti hai. Aavedan ke liye avashyak dastavej aam taur par kam hote hain, jisse ye prakriya pareshani-mukt hoti hai.

Kai Cash Nikalne ke Sadhan: Kisan Credit Card dvaara kisaan apne karz ka paisa ATMs, bank shakhaon, aur nirdharit Point of Sale (POS) outlet se nikal sakte hain. Isse karz ke sahaj pahunch ki vyavastha hoti hai jab bhi avashyak ho.

Byaj Subsidy: Sarkar kisaanon ko Kisan Credit Card karz par byaj subsidy pradaan karti hai, jisse byaj ki bhugtan ki bojh kam ho jata hai. Subsidy ka raashi sarkar dvaara nirdharit kanoon aur yogyata mukhya nirdeshon ke aadhar par alag-alag ho sakti hai.

Bima Sankhyak: KCC dhaarak bhi bima sankhyak ke liye yogy ho sakte hain, jisse fasal ke kharab hone, durghatnaon ya anya aakasmik paristhitiyon mein arthik suraksha prapt hoti hai.

Vittiya Sanyog ko Badhava: KCC yojna kisaan bhaiyon ke beech vittiya sanyog ko badhane ka lakshya rakhti hai, unhe ek maanyata prapt karz suvidha pradaan karke. Isse unhe bhavishya mein anya vittiya sevaon tak pahunchne mein madad milti hai.

Saral Aavedan Prakriya: KCC aavedan prakriya ko saral banaya gaya hai taki kisaan karz card ke liye aavedan karne mein aasani ho. Aavedan ke liye avashyak dastavezikaran kam hai aur aavedan ko kisaan ki suvidha ke anusaar online ya offline tareeke se jama kiya ja sakta hai.

Vistarit Coverage: Kisan Credit Card krishi ki kai avashyaktaon ke liye coverage pradaan karta hai. Yeh kheti ke liye avashyak input, upkaran, yantra aur saamanon ki khareedari ko support karta hai, jisse kisaan apni krishi utpadan aur aay ko badha sakte hain.

Bima Sankhyak: KCC dhaarak aakasmik ghatnaon jaise fasal ka kharab hona, durghatnaon aur prakritik aapdaon ke khilaaf bima sankhyak ke liye yogy hote hain. Yeh kisaanon ko ek suraksha jaal pradaan karta hai aur unhe arthik nuksan se bachata hai.

Ye kuch mukhya fayde hain Kisan Credit Card yojna ke, jise kisaanon ki sahayata aur unke krishi karyon ke vittiya avashyakton ko poora karne ke liye banaya gaya hai.

Documents Required For Kisan Credit Card Online Apply 2023?

Kisan Credit Card (KCC) ke liye Online Aavedan karne ke liye avashyak dastavezon ki list nimnlikhit hai:

- Aavedan Praman Patra: KCC ke liye aavedan karne ke liye, aapko pahle se tayyar kiye gaye aavedan praman patra ko bharna hoga. Isme aapko apne vyaktigat aur krishi se sambandhit jaankariyan deni hogi.

- Identity Proof: Aapko apni pahchan praman patra ki copy prastut karni hogi. Isme aap apna Aadhaar Card, Voter ID Card, Pan Card, Passport ya koi bhi sarkari pahchan patra ka upyog kar sakte hain.

- Address Proof: Aapko apni pate ki praman patra ki copy prastut karni hogi. Isme aap apne niwas praman patra, bijli ka bil, bank ka passbook, ya koi bhi sarkari dastavez ka upyog kar sakte hain.

- Land Ownership Proof: Agar aap zameen ke malik hain, toh aapko zameen ke praman patra ki copy jama karni hogi. Isme aap apne kheti bhoomi ke khatauni, patta ya anya sarkari dastavez ka upyog kar sakte hain.

- Income Proof: Aapko apni aay ki praman patra ki copy prastut karni hogi. Isme aap apne kheti se prapt hone wali aay ki ginti, bank passbook ki copy ya koi bhi aay se sambandhit dastavez jama kar sakte hain.

- Passport-Size Photograph: Aapko kuch passport-size tasveeron ki prateeksha karni hogi. Yeh tasveerein aapke aavedan praman patra mein upyog ki jayengi.

- Bank Statement: Aapko apne bank khate ki 6 mahine ka bank statement prastut karna hoga. Isse aapki karz ki bhugtan kshamta ka aakalan kiya jayega.

- Crop Details: Aapko apni fasalon ki jaankari prastut karni hogi. Isme aapko fasalon ke bare mein suchna deni hogi, jaise fasal ke prakar, bhoomi par ugane ki taarikh, fasal ke kaaran hone wale nuksaan ka varnan adi.

Yeh dastavezon ki list aam taur par Kisan Credit Card Online Aavedan ke liye maangi jaati hai. Aapke bank dwara tay kiye gaye niyamon aur yogyataon par bhi nirbhar karegi. Isliye, aavedan karne se pahle apne bank ke saath sampark karein aur unse visheshtayein prapt karein.

Kisan Credit Card Ke Liye Bank Se Awedan Kaise Kare?

Kisan Credit Card (KCC) ke liye online aavedan karne ke liye, aapko kuch kadam follow karne honge. Yahan Kisan Credit Card Online Aavedan 2023 ke liye prakriya di gayi hai:

- Bank ke Najdiki Shakhah Mein Jaaye: Sabse pehle, apne najdiki bank ke shakhah par jaaye jo Kisan Credit Card suvidha pradaan karti hai.

- KCC Aavedan Prapat Karein: Bank ke shakhah par pahuchte hi, KCC aavedan prapat karne ke liye prarthna karein. Bank ke adhikari aapko KCC aavedan prapat karte samay aavedan prapatr pradaan karenge.

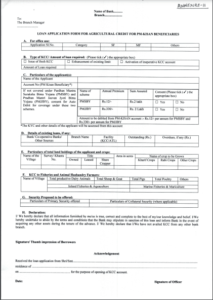

KCC aavedan prapatr aam taur par nimnlikhit jaankariyon ko maangta hai:Kcc

- Vyaktigat jaankari: Naam, pata, sampark jaankari, aadi.

- Zameen ki jaankari: Zameen ka size, zameen ka prakar, malikana jaankari, aadi.

- Fasal aur krishi ki jaankari: Ugai jaane wali fasal ka prakar, fasal ki vyavastha, sinchai suvidhayein, aadi.

- Karz ki avashyakta: Avashyak hone wala karz ka raashi, karz ka uddeshya, aadi.

- Anya zaroori jaankari: Bank khate ki jaankari, aay ki jaankari, aadi.

- Aavedan Prapatr Bharein: KCC aavedan prapatr ko dhyan se aur sahi tareeke se bharein. Sabhi zaroori jaankariyan pradaan karein aur surakshit rahein ki jaankari sahi ho.

- Aavedan Jama Karein: Aavedan prapatr bharne ke baad use bank ke adhikariyon ko jama karein. Ve aapko aage ki prakriya mein sahayata denge aur avashyak anya sujhaav pradaan karenge.

- Sahayak Dastavez Jama Karein: Aavedan prapatr ke saath-saath aapko kuch sahayak dastavez bhi jama karne honge. Ye dastavez nimnlikhit ho sakte hain:

- Pahchan praman patra (Aadhaar card, voter ID card, passport, aadi).

- Pata praman patra (Aadhaar card, utility bills, driving license, aadi).

- Zameen ke maalikana dastavez ya zameen se sambandhit dastavez.

- Aay praman patra (aay praman patra, income tax returns, bank ki ghoshnaayein, aadi).

- Krishi se sambandhit dastavez (fasal ki jaankari, fasal ki vyavastha, aadi).Kisan Credit Card (KCC) ke liye online aavedan karne ke liye, aapko kuch kadam follow karne honge. Yahan Kisan Credit Card Online Aavedan 2023 ke liye prakriya di gayi hai:

- Verification and Approval: : Bank aavedan prapatr mein di gayi jaankari aur sahayak dastavezon ki jaanch karega. Jab jaanch poora ho jaaye aur sabhi maangon ko poora kiya jaye, tab bank aapke Kisan Credit Card ke liye aavedan ko prakriya karega.

- Card Prapti: Agar aapka aavedan manzoor ho jata hai, to bank aapko Kisan Credit Card pradan karega. Aap card ke saath saath uske upyog ke liye zaroori saamanvay ki saari jaroori jaankari prapt karenge.

Dhyaan dena zaroori hai ki bank se bank alag-alag ho sakti hai aur isliye Kisan Credit Card ke aavedan prakriya aur maangon mein thodi si antar ho sakta hai. Isliye, Kisan Credit Card aavedan prakriya se sambandhit vistarit jaankari ke liye apne najdiki bank shakhah se sampark karna ya unki official website par jaana pramukh hai.

Simple And Easy Step By Step Online Process of Kisan Credit Card Online Apply 2023?

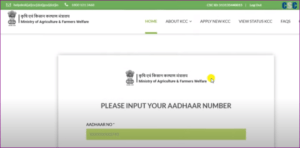

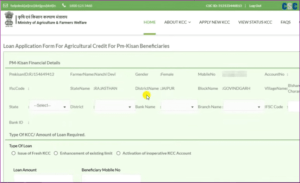

Kisan Credit Card ko online aavedan karne ke liye, nimnlikhit kadam follow karne honge:

- Official Website Par Jaaye: Sabse pehle, Kisan Credit Card ki suvidha pradaan karne wale bank ki official website par jaaye. Homepage par “KCC Online Apply” ya “Abhi Aavedan Karein” wale section ko khojein.

- KCC Aavedan Vikaalp Ko Chunein: KCC aavedan prashasan par pahunchte hi, “Kisan Credit Card Online Apply” ya kisi aise vikaalp ko chunein.

- Vyaktigat aur Krishi Se Sambandhit Jaankari Pradaan Karein: Online aavedan prapatr mein maang ki gayi jaankari ko bharnein. Isme vyaktigat jaankariyan jaise aapka naam, pata, sampark jaankari aur krishi se sambandhit jaankariyan jaise zameen ki jaankari, fasal ki jaankari, aadi shaamil ho sakti hain.

- Sahayak Dastavezon Ko Upload Karein: Aavedan prapatr par di gayi maang ke anusar zaroori sahayak dastavezon ko scan karke upload karein. Ye dastavezon mein pahchan praman patra, pata praman patra, zameen ke maalikana dastavez, aay praman patra aur krishi se sambandhit dastavez shaamil ho sakte hain. Dastavezon ke saaf aur padhne layak copy upload karna zaroori hai.

- Jaanch aur Jamaa Karein: Aavedan jama karne ke baad, bank aapke pradaan ki gayi jaankari ko jaanchega aur verify karega. Zaroorat padne par vah aapko aur dastavezon ki aavashyakta ke liye sampark kar sakta hai. Jaanch prakriya mein thoda samay lag sakta hai.

- Aavedan Ka Stithi aur Manzoori: Aap apne aavedan ka stithi ko apne bank account mein login karke ya diye gaye aavedan sanketank number ka upyog karke track kar sakte hain. Jab aapka aavedan manzoor ho jata hai, to bank aapko email, SMS ya website ke madhyam se suchit karega.

- Card Prapti aur Pahunch: Agar aapka aavedan safal hota hai, to bank aapko Kisan Credit Card pradaan karega. Aapka card aapke register kiye gaye pate par bheja jayega ya aap use bank shakhah se prapt kar sakte hain, bank ke nirdhaarit prakriya ke anusar.

Dhyaan dena zaroori hai ki online aavedan prakriya bank ke anusar thoda alag ho sakti hai. Isliye, Kisan Credit Card ke liye online aavedan karne ki vishesh suvidhaon aur pramaanikaran ke liye bank ki official website par jaana ya unke customer service se sampark karna pramukh hai.

Kisan Credit Card Online Apply 2023 :- Quick Link

| Direct Link To Apply | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Summary:

Main khush hoon sunke ki aapko yeh article pasand aaya aur yeh kisanon ke vikas ke liye samarpit hai. Hum Kisan Credit Card aur uske online aavedan prakriya par vistarit jaankari pradaan karne ka lakshya rakhte hain Kisan Credit Card Online Apply 2023 mein. Hamara uddeshya hai kisanon ki madad karna taki ve Kisan Credit Card ke liye jald se jald aavedan kar sakein aur iska fayda utha sakein.

Article ke ant mein, hum ummid karte hain ki sabhi kisan log ise padhne ka aanand utha rahe hain. Aap se guzarish hai ki aap ise pasand, share aur comment karein.

Agar aapke paas aur koi sawal hai ya aur madad ki zaroorat hai, toh hamein poochhne ke liye swatantrata se puchiye. Comments karke

FAQ’s – Kisan Credit Card Online Apply 2023

Yahaan kuch aise aksar puche jaane wale sawaal (FAQs) hain jo Kisan Credit Card Online Apply 2023 se sambandhit hain:

Sawal 1: Kisan Credit Card kya hai?

Jawaab 1: Kisan Credit Card (KCC) ek vishesh roop se kisanon ke liye banaya gaya credit facility hai jo Bharat mein upalabdh hai. Isse kisanon ko sastey mein credit pradaan kiya jaata hai taki ve apne krishi se sambandhit zarooraton aur kharchon ko poora kar sakein.

Sawal 2: Main Kisan Credit Card ke liye online kaise aavedan kar sakta hoon?

Jawaab 2: Kisan Credit Card ke liye online aavedan karne ke liye, kisi bhi bank ki official website par jaayein jo KCC ki suvidha pradaan karti hai. “KCC Online Apply” ya koi aise vikalp ko khojein, aavashyak jaankari bharke, zaroori dastavezon ko upload karke aur aavedan prapatr submit karein.

Sawal 3: Kisan Credit Card Online Apply ke liye kaun se dastavez zaroori hote hain?

Jawaab 3: Dastavezon ki zaroorat bank se bank alag ho sakti hai. Aam taur par, aapko pahchan pramaan, pata pramaan, zameen ke maalikana dastavez, aay pramaan aur krishi se sambandhit dastavezon ki zaroorat hogi. Bank ki website ya unke customer service se vishesh dastavezon ki maang ke liye sampark karein.

Sawal 4: Kisan Credit Card ke madhyam se mujhe sabse adhik loan kitna mil sakta hai?

Jawaab 4: Sabse adhik loan raashi vibhinn karanon par nirbhar karti hai jaise aapki zameen ki badi, fasalon ke vyavasayik pattern aur chukane ki shamta. Aam taur par, KCC yojana ke antargat kisan INR 3 lakh tak ka loan prapt kar sakte hain.

Sawal 5: Kisan Credit Card loan par lagne wali byaaj dar kya hai?

Jawaab 5: Kisan Credit Card loan par byaaj dar aam taur par sastey hoti hai. Kisanon ko lagbhag 7% byaaj dar dena hota hai aur samay par chukane par unhe 3% tak ki byaaj dar ka concession prapt ho sakta hai.

Sawal 6: Kya main Kisan Credit Card ko asrkari upyog ke liye istemal kar sakta hoon?

Jawaab 6: Kisan Credit Card ka mukhya uddeshya kisanon ki krishi se sambandhit zarooraton ko poora karna hai. Halaanki, kuch bank card ka seemit upyog non-krishi karyaon ke liye allow kar sakte hain. Vishesh smaajhdari ke liye apne bank se specific smaajhdariyon ki jankari prapt karein.