Qualification and Features of NIRA Instant Personal Loan

Agar aap ek NIRA Instant Personal Loan ke liye ek bahut hi saral prakriya ke madhyam se aavedan karna chahte hain, toh aap oopar di gayi jaankari ko padhkar aasani se kar sakte hain. Halaanki, aavedan karne se pahle, NIRA application dvaara nirdharit mukhya gun aur yogyata moolyon ko jaan lena mahatvapurn hai, jo nimn hain:

- Aavedak Bharatiya nagarik hona chahiye.

- Aavedak ko nirdharit aay prapt karna avashyak hai.

- Aavedak ka minimum maasik vetan ₹12,000 ya usse adhik hona chahiye.

- Aavedak ka ayu 22 se lekar 59 varsh ke beech honi chahiye.

Iske alawa, NIRA application ke madhyam se vyaktigat loan prapt karna chahte aavedak ko ek 3 mahine ka bank vaarshik vittiya vyaapaar aur anya avashyak dastavejon ka pradaan karna hoga. Upar di gayi jaankari ko padhkar, aapko NIRA Instant Personal Loan ke liye aavedan karne ke mukhya gun aur yogyata moolyon ka samajh aa gaya hoga.

NIRA Instant Personal Loan Apply Karne ke Liye Inportant Documents

Agar aap ek NIRA Instant Personal Loan ke liye online aavedan karna chahte hain, toh aap ise aasani se kar sakte hain. Halaanki, aavedan karne se pahle, aapko sabhi avashyak dastavejon ka pradaan karna hoga. NIRA Instant Personal Loan ke liye online aavedan karne ke liye, aapko neeche diye gaye sabhi avashyak dastavejon ko poora karke aavedan prakriya ko aasani se poora karna hoga:

- PAN Card

- Aadhaar Card

- 3 mahine ka Bank Statement

- Aadhaar se jude Mobile Number

- Email ID

- Aavedan ke samay jivit Selfie Photo Upar diye gaye sabhi dastavejon ko poora karke, aap ek bahut hi saral aur seedha prakriya ke madhyam se NIRA Instant Personal Loan aasani se praapt kar sakte hain.

How to Online Apply NIRA Instant Personal Loan 2024?

Agar aap NIRA Instant Personal Loan ke liye aavedan karne ka kadam-sankhya margadarshan jaanana chahte hain aur seedha ₹5000 se lekar 1 lakh tak apne khate mein prapt karna chahte hain, toh aap neeche diye gaye online aavedan ke kadam ko follow kar sakte hain:

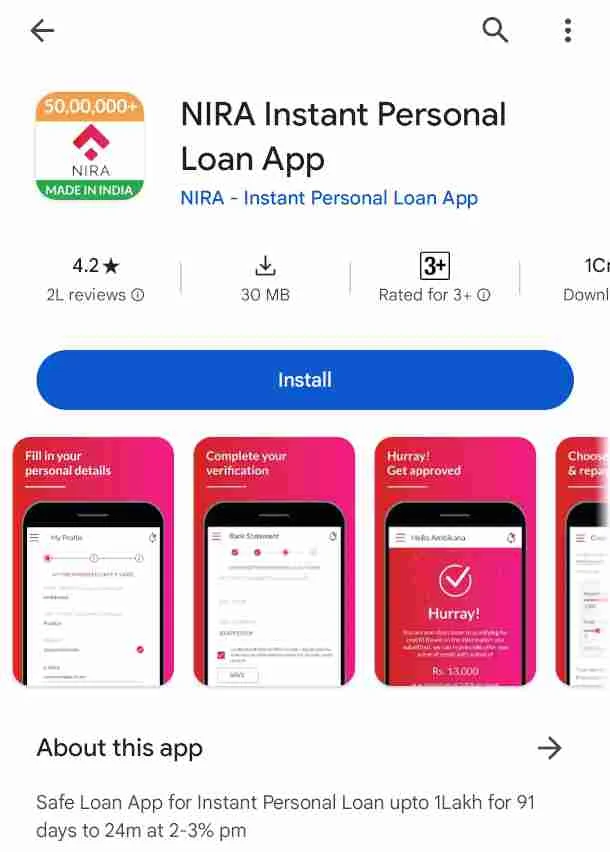

1. Sabse pehle, apne smartphone par Google Play Store application ko kholen.

2. Khoj vikalp par klik karen aur “NIRA Instant Personal Loan” ko khojen.

3. NIRA application ko apne mobile phone par install karen, jo is tarah dikhega: NIRA Instant Personal Loan.

4. Install karne ke baad, application ko kholen aur application dvara maangi gayi sabhi anumatiyon ko grant karen.

5. Phir, apna 10 ank ka mobile number daalen aur “OTP Bhejen” par klik karen.

6. Aapko apne mobile par ek OTP prapt hoga, OTP daalen aur “Verify” vikalp par klik karen.

7. OTP ko verify karne ke baad, aapke screen par loan aavedan form dikhai dega.

8. Aavedan form mein saari aavashyak jaankari ko vistaar se daalen.

9. Saari jaankari daalne ke baad, aapko di gayi jaankari ke aadhaar par anumodhan rupaya dikhayi dega.

10. Ab, “Apply Now” vikalp par klik karke apna loan aavedan poora karen.

11. Agla kadam, ek live selfie photo len aur apna PAN card upload karen.

12. Apne poore pate ki jaankari daalen.

13. Uske baad, apne bank ke vivaran daalen aur apne 3 mahine ka bank vaarshik vittiya vyaapaar upload karen ya internet banking ke madhyam se apne bank ke vivaran ko verify karen.

14. Jab aapke bank ke vivaran ko verify kar diya jata hai, tab aapko Aadhaar e-KYC ke liye gujarish ki jayegi.

15. Aadhaar e-KYC ko poora karne ke liye, apna 12 anko ka Aadhaar number daalen.

16. Aadhaar number daalne ke baad, “Send OTP” par klik karen.

17. Aapko apne panjikrit mobile number par ek OTP prapt hoga, OTP daalen aur “Verify” vikalp par klik karen.

18. “Verify” vikalp par klik karne ke baad, aapka NIRA Instant Personal Loan aavedan safal roop se submit ho jayega.

19. Aavedan submit hone ke baad, aapka aavedan samaikit kiya jayega, aur manjur loan rashi aapke khate mein jama ki jayegi.

Upar di gayi jaankari ko dhyan se padhkar, aapko NIRA Instant Personal Loan ke liye aavedan karne ka poora kadam-sankhya margadarshan aasani se samajh aa gaya hoga, ek bahut hi saral aur seedha prakriya ke madhyam se.

Saransh: Is article mein, humne vistar se bataya hai ki kaise aap ek NIRA Instant Personal Loan ke liye aavedan kar sakte hain, jo aap ek bahut hi saral aur seedha prakriya ke madhyam se aasani se samajh gaye hain. Aapki jaankari ke liye, aavedak ko NIRA Instant Personal Loan ke liye vetan prapt vyaktiyon hona chahiye. NIRA Instant Personal Loan ke liye aavedan karke, aap ₹5000 se lekar 100000 tak ke rashi praapt kar sakte hain.

Dosto, main ummeed karta hoon ki aap sabhi ne is article ko ant tak padha hoga aur ise bahut pasand kiya hoga, jiska aap zaroor pasand, share aur comment karenge.