SBI Online E Mudra Loan Apply 2023:-Agar aap State Bank of India (SBI) ke savings account holder hai aur aapko urgent paise ki zaroorat hai, toh ab aap SBI ke Pradhan Mantri Mudra Yojana ke antargat ek turant loan tak up to ₹50,000 ka laabh utha sakte hai. SBI ne apne sabhi account holders ke liye SBI Online E Mudra Loan Apply ke online process ko shuru kiya hai. SBI ke savings account holders ab Mudra loan yojana ke antargat turant ₹50,000 ka laabh utha sakte hai.

Isliye, is article ke madhyam se hum aapko SBI Online E Mudra Loan Apply ke liye apply kaise karna hai, iske bare mein ek vistar se guide pradan karenge. Mai aapko puri step-by-step application process ke saath saari mahatvapurn jaankari pradan karunga. Halaanki, article ke aage badhne se pahle, hum aapko suchit karna chahenge ki SBI Online E Mudra Loan Apply ke liye aapko kuch dastavej aur yogyata pehle se taiyaar rakhne ki avashyakta hogi, taaki aap apply karte samay koi bhi pareshaani na ho.

Is article ko padhkar aap aasani se SBI Online E Mudra Loan Apply ke liye apply kaise karna hai, iska gyaan prapt kar sakte hai. Vartamaan mein, State Bank of India SBI account holders ko e-mudra loan pradan kar rahi hai, ek bahut hi saral prakriya ke madhyam se. E-mudra loan ke antargat, sabhi account holders sidhe tarike se apply kar sakte hai aur turant ₹50,000 tak ka loan prapt kar sakte hai.

Table Of Contents Hide SBI Online E Mudra Loan Apply – Short Details |

| Article Ka Name | SBI Online E Mudra Loan Apply |

| Article Ka Type | Others |

| Bank Ka Name | State Bank of India |

| Apply Ka Mode | Online |

| Loan Ka Type | Mudra Loan |

| Who Can Apply? | Sabhi State Bank Of India Account Holder |

| Charges of Application | As Per Applicable |

| Loan Amount | ₹50000 Up to 10 Lac |

| Official Website | https://emudra.sbi.co.in |

SBI Se Mil Raha Ghar Baithe Mudra Loan Bina Kisi Deri Ke Turant Aise Le ₹50000 Mudra Loan – SBI Online E Mudra Loan Apply

Hum sabhi pustakarthao aur padhne waalo ko hardik badhai dete hai, jo is article ko padhne ke liye samay nikal kar padh rahe hai. Aap sabhi Pradhan Mantri Mudra Yojana ke antargat ₹50,000 se adhik ka loan aasani se prapt kar sakte hai. Mudra loan prapt karne ke liye online prakriya State Bank of India dawara shuru ki gayi hai. Is article mein hum aapko SBI Online E Mudra Loan Apply ke liye apply kaise karna hai, iske bare mein ek vistar se step-by-step guide pradan karenge.

Iske saath hi, hum aapko vistar se bataana chahte hai ki SBI Online E Mudra Loan ke liye apply karne ke liye abhyaarthiyon ko online prakriya ka anusaaran karna hoga. Mudra loan online apply karte samay koi bhi pareshaani ya samasya nahi honi chahiye aur iske liye hum aapko puri jaankari ke saath step-by-step application process pradan karenge, jisse aap SBI Online E Mudra Loan Apply ke bare mein ant tak vistar se jaan sakenge.

– Required Eligibility SBI Online E Mudra Loan Apply

SBI Online E Mudra Loan ke liye apply karne ke liye, abhyaarthiyon ko bank dwara nirdharit kuchh niyamak sharten poori karni hogi. Neeche diye gaye hai SBI Online E Mudra Loan ke liye aavashyak yogyata maapdando:

- Abhyaarthi Bharat ke nivaasi hona chahiye.

- Abhyaarthi kam se kam 18 saal ka hona chahiye.

- Abhyaarthi ko State Bank of India (SBI) mein ek bachat khata hona chahiye.

- Abhyaarthi ke SBI khate mein gatividhi honi chahiye aur usmein acchi transaction ki history honi chahiye.

- Abhyaarthi ka credit score accha hona chahiye aur kisi bhi prakaar ka loan bhugtaan kiya na ho.

- Abhyaarthi ke paas ek sahi PAN card hona chahiye.

Yadi abhyaarthi in sabhi yogyata maapdando ko poora karta hai, to vah SBI Online E Mudra Loan ke liye aavedan kar sakta hai.

SBI Online E Mudra Loan Apply – Required Documents

SBI Online E Mudra Loan ke liye aavedan karne se pahle, abhyaarthiyon ko aavedan prakriya shuru karne se pahle kuchh dastavej tayyar rakhne ki avashyakta hogi. SBI Online E Mudra Loan ke liye aavashyak dastavej is prakar hai:

- Ek sahi PAN card

- Aadhaar card ya koi anya sahi ID pramaan patra

- Passport size photograph

- Pichhle 6 mahine ke bank ka bank statement

- Vyapar ke pramaan ke roop mein Shop Establishment Certificate, GST Registration Certificate, aadi jaise dastavej

- Vyapar ka pata suchit karne ke liye bijli bill, telephone bill, aadi jaise dastavej

Avedan prakriya shuru karne se pahle abhyaarthiyon ko yah sunishchit kar lena chahiye ki unke paas sabhi zaroori dastavej tayyar hai, taki aavedan prakriya ke dauraan koi pareshaani na ho.

Quick And Easy Simple Steps to SBI Online E Mudra Loan Apply 50000?

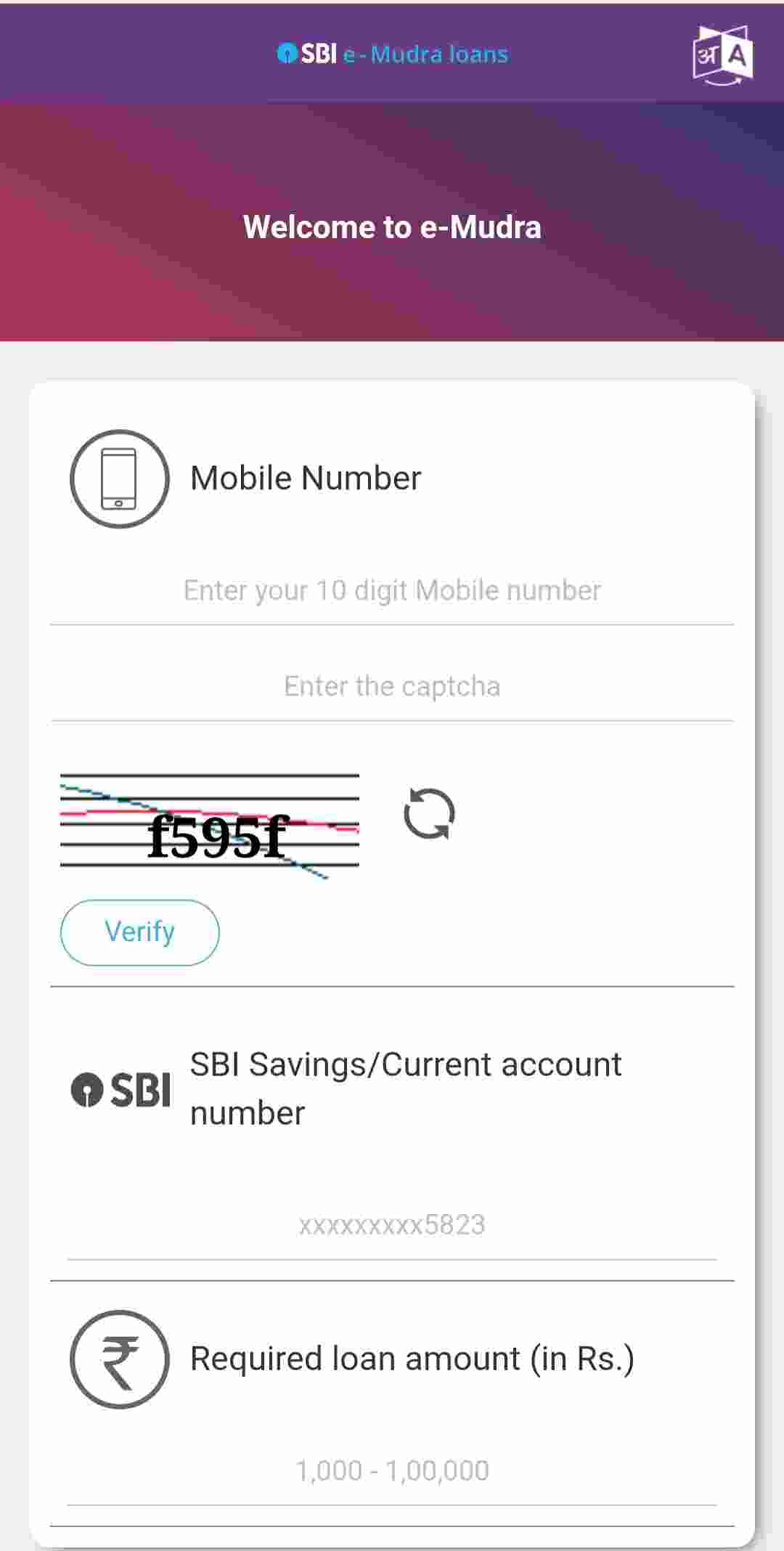

SBI e-Mudra Loan ka online application kaise karein, iske liye ye steps follow karein:

- SBI website par jaaye aur e-Mudra Loan page par jaakar “Apply Now” button par click karein.

- Application form mein aapki personal details, business information, loan amount, aur aur zaroori jaankari bharein.

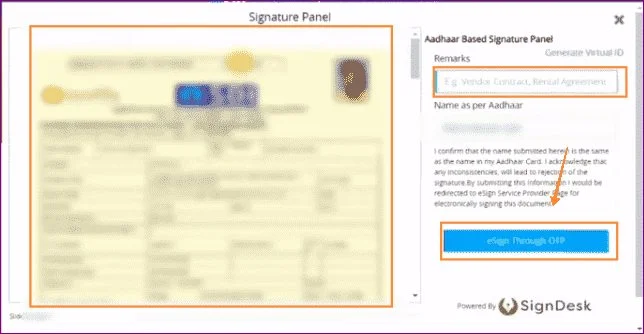

- Zaroori documents jaise ki identity proof, address proof, aur business proof upload karein.

- Application form ko submit karne se pehle saari details ko review kar lein.

- Submit button par click karke application process complete karein.

- SBI representative aapko contact karenge aur aapki details verify karenge.

- Verification process complete hone ke baad, loan amount aapke bank account mein transfer ho jayega.

Dhyaan rakhein ki eligibility criteria, loan amount, interest rates, aur terms and conditions scheme ke hisaab se alag-alag ho sakte hain. Loan ke liye apply karne se pehle saari terms and conditions dhyaan se padh lein.

SBI Online E Mudra Loan Apply 2023:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Summary

Is article mein humne SBI Online E Mudra Loan Apply process aur Mudra Loan se judi sabhi jaankariyaan detail mein share ki hain. Is article ko ant tak padhkar aap SBI Online E Mudra Loan Apply ke liye application process ke baare mein jaan sakte hain. Abhi Indian SBI Online E Mudra Loan Apply ke antargat turant Mudra loans up to ₹50,000 offer kar rahi hai, aur aapko iske liye online apply karna hoga. Is article mein online apply karne se judi sabhi jaankariyaan share ki gayi hain.

Doston, hum ummeed karte hain ki aapne is article ko ant tak padha hoga, aur aapko ye article bahut pasand aaya hoga, jiske liye aap humare article ko zaroor like, share aur comment karenge.

FAQ’s – SBI Online E Mudra Loan Apply

Q: SBI Online E Mudra Loan kya hai?

A: SBI Online E Mudra Loan ek yojna hai jo State Bank of India ne choti aur micro enterprises ko financial support dene ke liye shuru ki hai.

Q: SBI Online E Mudra Loan ke liye eligibility criteria kya hai?

A: SBI Online E Mudra Loan ke liye eligibility criteria yojna ke specific e-Mudra loan scheme par nirbhar karta hai. Lekin amtaur par, borrower Indian citizen hona chahiye, choti ya micro enterprise mein busy hona chahiye aur pichhle kisi bhi loan ke payments par default nahi hona chahiye.

Q: SBI Online E Mudra Loan ke liye loan amount kitna ho sakta hai?

A: SBI Online E Mudra Loan ke liye loan amount scheme ke specific e-Mudra loan scheme par nirbhar karta hai. Lekin abhi SBI turant Mudra loans up to ₹50,000 offer kar rahi hai.

Q: SBI Online E Mudra Loan ke liye interest rate kya hai?

A: SBI Online E Mudra Loan ke liye interest rate yojna ke specific e-Mudra loan scheme par nirbhar karta hai. Lekin amtaur par, Mudra loans ke liye interest rate 9.75% se 11.50% ke beech hota hai.

Q: SBI Online E Mudra Loan ke liye kaise apply kar sakte hai?

A: Aap SBI website par jaakar SBI e-Mudra Loan webpage par jaakar aur application process follow karke SBI Online E Mudra Loan ke liye apply kar sakte hai.

Q: SBI Online E Mudra Loan Apply ke liye kaun se documents ki zaroorat hoti hai?

A: SBI Online E Mudra Loan Apply ke liye documents scheme ke specific e-Mudra loan scheme par nirbhar karta hai. Lekin amtaur par, identity proof, address proof, business proof aur zaroori documents ki zaroorat hoti hai.

Q: SBI Online E Mudra Loan ke liye repayment tenure kya hai?

A: SBI Online E Mudra Loan ke liye repayment tenure yojna ke specific e-Mudra loan scheme par nirbhar karta hai. Lekin amtaur par, Mudra loans ke liye repayment tenure 3 se 5 saal ke beech hota hai.