Bajaj Finserv Personal Loan:-Agar aapko urgent paise ki zaroorat hai aur pehle se hi rishtedaron ya padosiyo se udhaar maangne ki koshish kar chuke hai lekin funds jama karne mein asamarth hai, toh aap Bajaj Finserv Personal Loan ka vichaar kar sakte hai. Bajaj Finserv mobile application ke madhyam se aap ₹35 lakh tak ka personal loan prapt kar sakte hai. Agar aapko personal expenses ke liye urgent zaroorat hai, toh aap aasaani se Bajaj Finserv Personal Loan app ke madhyam se ₹50 lakh tak ka loan prapt kar sakte hai. Is article mein, main aapko step-by-step guide pradan karunga jisse aap Bajaj Finserv Personal Loan application ke madhyam se loan ke liye aavedan kar sakte hai.

Vartaman mein, Bajaj Finserv Personal Loan se aap ₹50,000 se lekar adhikatam ₹2,500,000 tak ka loan prapt kar sakte hai. Bajaj Finserv se personal loan lekar, aap ghar ki marammat, aapda, medical expenses, bachhon ke fees ya apni zarooraton ke mutabik kisi bhi prakar ki jarurat ko pura kar sakte hai. Is article ke aage ke hisson mein, main aapke saath byaakul roop se interest dar, fayde, visheshataayein aur yogyata maanadharan ke baare mein poora gyaan share karunga, saath hi Bajaj Finserv Personal Loan se loan prapt karne ke liye avashyak dastavez bhi bataunga. Isse aap aasaani se ghar baithe personal loan ke liye aavedan kar sakte hai.

Bajaj Finserv Personal Loan – Short Details |

| Article Ka Name | Bajaj Finserv Personal Loan |

| Article Ka Type | Latest Update |

| Loan Provider Company Name | Bajaj Finserv |

| Apply Mode | Online |

| Loan Ka Type | Personal Loan |

| Interest Rate | 11%-25% per annum |

| Procssing Fees | 2% से 8% तक |

| Processing Fees | Up to 4% of the loan amount |

| Loan Amount | ₹100000 Lac Up to 25 Lac |

| Bounce Charges | ₹ 600- ₹1,200 |

| Official Website | https://www.bajajfinserv.in/ |

Bajaj Finserv Personal Loan Aise Le 35 Lakh Rupye Tak Turant Loan

Ham sabhi is article ke sare pade likhon ko hardik badhai dete hain. Agar aap ₹100,000 se ₹55 lakh tak ka Bajaj Finserv Personal Loan prapt karne mein ruchi rakhte hain, toh kripya neeche diye gaye process ko follow karein. Aage badhne se pehle dhyaan dein ki aapko Bajaj Finserv Personal Loan ke liye online aavedan karna hoga aur aavedan ke liye zaruri dastavez pradan karna hoga.

Is article mein zaroori dastavezon ke baare mein vyapak jaankari di gayi hai. Article mein diye gaye sare zaruri dastavezon ko submit karke, aap Bajaj Finserv Personal Loan ke liye online aavedan kar sakte hain aur bina kisi physical location par jaaye, ₹35 lakh tak ka loan prapt kar sakte hain. Article mein aavedan prakriya ke baare mein saaf-suthri jaankari di gayi hai, jisse aap sabhi vistar padh kar samajh sakte hain.

Bajaj Finserv Personal Loan, intrest rate

Vartaman mein, Bajaj Finserv Personal Loan aapko ek saral aur seedha tarika pradan karta hai personal loan prapt karne ka. Agar aapko turant paiso ki zaroorat hai, toh aap apne mobile phone ke madhyam se Bajaj Finserv Personal Loan ke zariye ₹100,000 se ₹2,500,000 tak ka personal loan prapt kar sakte hai.

Halaanki, Bajaj Finserv Personal Loan lene se pehle bhi mahatvapurna hai ki aap interest dar ki concept samajh lein. Bajaj Finserv Personal Loan ke liye interest rate ko samajhna sujhaav diya jata hai, jo udhaar lene ka mahengaai ke roop mein hai. Bajaj Finserv Personal Loan ke liye interest rate saalana 11% se 25% tak hota hai. Interest rate aapko aapke praapt kiye gaye loan amount ke aadhaar par calculate kiya jaata hai, aur yeh aapke Equated Monthly Installment (EMI) ke saath, saath mein liye gaye interest ke saath bhi, tay karta hai. Alag-alag loan amounts ke liye EMI calculation ke liye alag-alag interest rates ho sakte hain.

Kripya dhyaan dein ki upar diye gaye interest rates par badlav ho sakte hain, aur sabse sahi aur up-to-date jaankari ke liye adhikarik Bajaj Finserv website ya unke customer support se sampark karna sujhaav diya jata hai.

Best Bajaj Finserv Personal Loan Benefits and Features

Bajaj Finserv Personal Loan ke kuch fayde aur visheshataayein hai:

- High Loan Amount: Bajaj Finserv Personal Loan aapko uchit loan amount pradaan karta hai, jiske range ₹100,000 se ₹3,500,000 tak hoti hai, aapki yogyata par nirbhar karte hue.

- Flexible Repayment Tenure: Aap apne personal loan ke liye suvidha ke anusaar ek aasaan repayment avdhi chun sakte hai, joki 12 se 60 mahine tak ho sakti hai, aapke arthik kabiliyat aur pasand ke anusar.

- Quick Approval and Disbursal: Bajaj Finserv aapko ek seemit samay mein loan approval prakriya pradaan karta hai. Jab aapka aavedan manjoor ho jata hai, toh loan amount kuch kaam karne wale dino ke andar aapke bank account mein transfer ho jata hai.

- Minimal Documentation: Bajaj Finserv Personal Loan ke liye documentation prakriya saral hai aur kam paperwork ki zaroorat hoti hai, jisse aavedakon ke liye suvidha ka sadhan banata hai.

- Online Application: Aap Bajaj Finserv Personal Loan ke liye unki adhikarik website ya mobile application ke madhyam se online aavedan kar sakte hai, aapke samay aur mehnat ko bachate hue.

- Competitive Interest Rates:Bajaj Finserv personal loan par takkar daar interest rates pradaan karta hai, jisse loan ki uplabdhi aur lagat-prabhavitata ka dhyan rakha jata hai.

- No Collateral Required: Bajaj Finserv Personal Loan ek asurakshit loan hai, jiske tahat aapko koi jamanat ya suraksha pradaan karne ki zaroorat nahi hoti hai.

- Flexi Loan Facility: Bajaj Finserv aapko flexi loan suvidha pradaan karta hai, jiske dwara aap apne manjoorit loan amount se zaroorat ke anusaar dhan nikal sakte hai. Aapko sirf upyogit rashi par hi bhatta dena hota hai, poore manjoorit loan amount par nahi.

- Pre-approved Offers: Bajaj Finserv maujooda grahakon ko pehle se manjoorit loan prastava pradaan kar sakta hai, jisse loan aavedan prakriya aur bhi saral aur teji se ho jati hai.

Ye kuch mukhya fayde aur visheshataayein hai Bajaj Finserv Personal Loan ki. Halaanki, aavedan karne se pehle Bajaj Finserv dwara pradaan ki gayi niyamon aur shartom, yogyata maanadharan aur anya jaankari ko dhyan se jaanch lena sujhaav diya jata hai.

Bajaj Finserv Personal Loan Eligibility Kya Hai

Bajaj Finserv Personal Loan ke liye yogyata ki kuch mahatvapurna shartein hai. Neeche diye gaye kuch samanya yogyata maanadharan hai:

- Aapka umar kam se kam 23 saal hona chahiye aur adhik se adhik 58 saal tak hona chahiye.

- Aapko ek nagrik hona chahiye aur Bharatiya nagrik hone ki pramanik dastavej pradan karna hoga.

- Aapko sthayi naukri ya vyavsayik upasthiti honi chahiye, jisse aapki income aur punah vapsi ka pramanit ho sake.

- Aapki maasik aay ke adhaar par loan ki punah vapsi ki kabiliyat hai, isliye aapki maasik aay ko maanak ki tarah pramanit karna hoga.

- Aapki credit score aur credit history bhi ek mahatvapurna maanadharan hai, jisse aapki loan yogyata ka nirnay hota hai.

- Aapke dwara pradan kiye gaye dastavez aur dokumentation ke anusaar Bajaj Finserv ki nirdharit maanak ko poora karna hoga.

Yeh kuch samanya yogyata maanadharan hai Bajaj Finserv Personal Loan ke liye. Aapko Bajaj Finserv ki adhikarik website ya customer support se sampark karke aur puri jaankari prapt karne ki salah di jaati hai, kyunki yogyata sharte samay ke saath badal sakti hai aur aapko sahi jaankari prapt karne ke liye unki sahayata leni chahiye.

Bajaj Finserv Personal Loan Required Documents ?

Bajaj Finserv Personal Loan ke liye aavashyak dastavez (documents) nimn hai:

- Proof of Identity (Pehchan Praman Patra): Aadhaar Card, PAN Card, Voter ID Card, Passport, Driving License, etc.

- Proof of Address (Nivas Praman Patra): Aadhaar Card, Passport, Voter ID Card, Utility bills (Electricity/Water/Gas bill), Rental Agreement, etc.

- Proof of Income (Aay Praman Patra): Salary Slips (for salaried individuals), Income Tax Returns (ITR), Bank Statements, Form 16, etc.

- Passport-size Photographs (Passport-size Tasveerein)

- Completely filled and signed Loan Application Form (Yojana Avedan Patra)

- Bank Statements (6 months) reflecting salary credits and financial transactions (6 mahine tak ke bank vayvahar pradarsh karne wale bank statements)

- Employment Proof (Naukri Ka Praman Patra): Employment ID card, Appointment Letter, Salary Certificate, etc. (for salaried individuals)

- Business Proof (Vyapar Ka Praman Patra): Business Registration Certificate, GST Registration Certificate, Shop Establishment Certificate, etc. (for self-employed individuals)

- Additional Documents: Depending on the specific requirements of Bajaj Finserv, additional documents such as Property Documents, Income Proof of Co-applicant, etc., may be required.

Yeh kuch aavashyak dastavez hai Bajaj Finserv Personal Loan ke liye. Dhyan dein ki dastavezon ki maang aur pramanikta company ke niyamon aur shartom par nirbhar karti hai. Aapko Bajaj Finserv ki adhikarik website ya customer support se sampark karke puri jaankari prapt karne ki salah di jati hai, taaki aap sahi aur aavashyak dastavez prastut kar sakein.

Quick And Simple Step Online Bajaj Finserv Personal Loan

Bajaj Finserv Personal Loan ke liye aavedan karne ke liye, neeche diye gaye Steps-Steps par prakriya ka palan karen. Uske baad, aap Bajaj Finserv Personal Loan ke liye online aavedan kar sakte hain, jismein ₹100,000 se ₹3,500,000 tak ke loan pradaan kiye jaate hain. Yahan tak aavedan karne ka tarika hai:

- Apne mobile phone par Google Play Store ko kholein.

- Search option par click karen aur search bar mein “Bajaj Finserv” likhen.

- Bajaj Finserv mobile application ko apne phone par download aur install karen.

- Dhyan dein ki yeh kadam thode se alag ho sakte hain, aapke istemal kar rahe device aur operating system par nirbhar karte hue.

- Jab aap Bajaj Finserv mobile application ko install kar lete hain, toh aap usi app ke andar loan aavedan prakriya ke saath agey badh sakte hain.

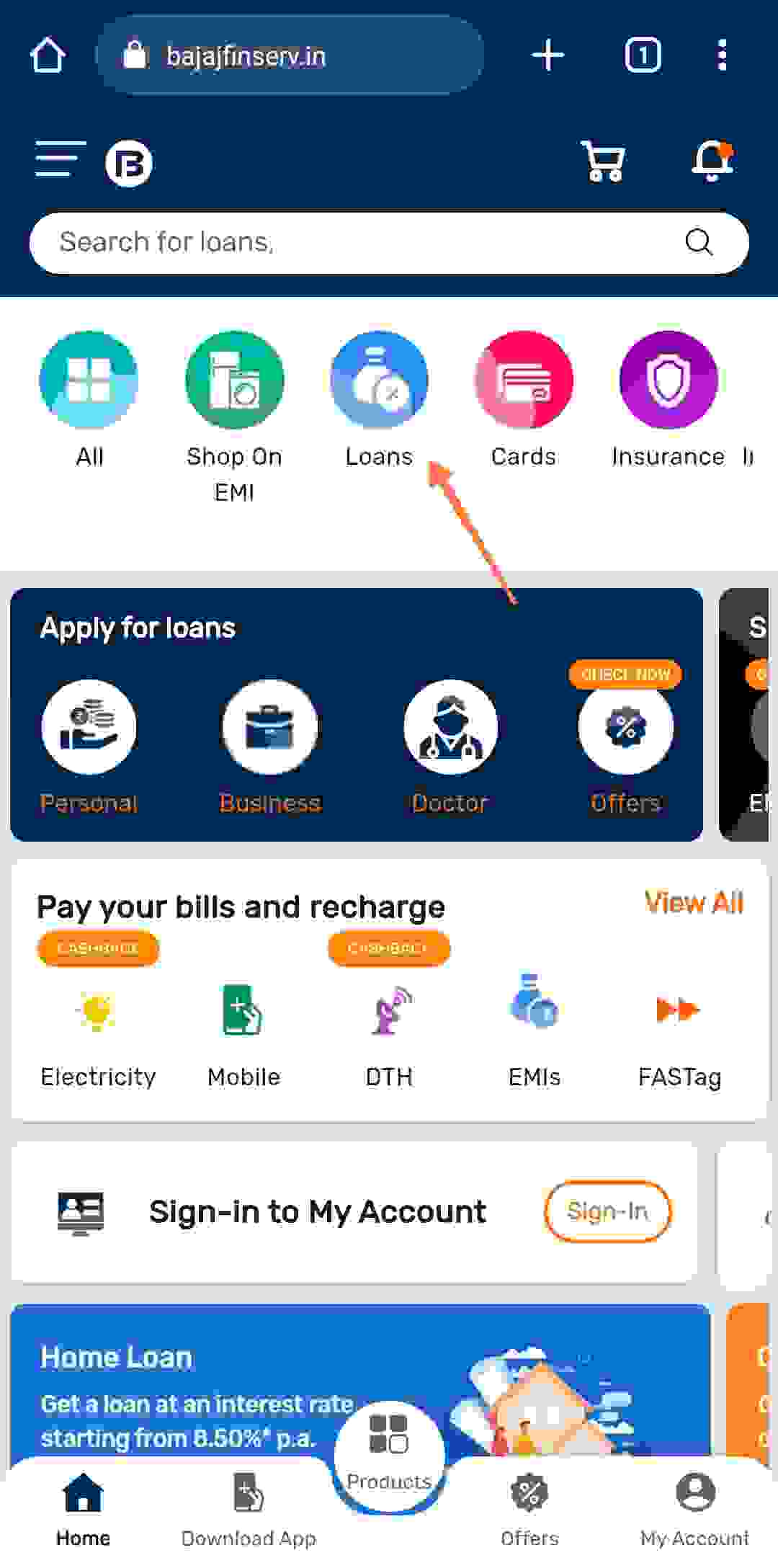

- Ab, apna mobile number aur kuch mahatvapurna jaankari enter karke Bajaj Finserv mein log in karen.

- Jab aap log in karte hain, aapko yeh dashboard dikhayi dega:

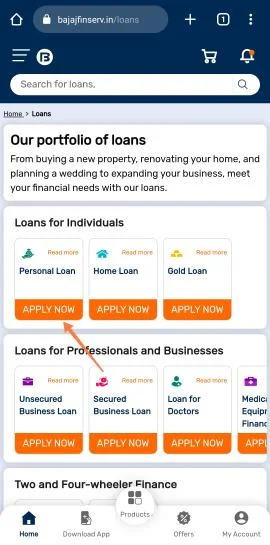

- Ab Personal Loan Par click Kar de

- Jab Aap personal Loan Par Click Kar denge Fir Apply Now Ke Buttun Par Click Kare

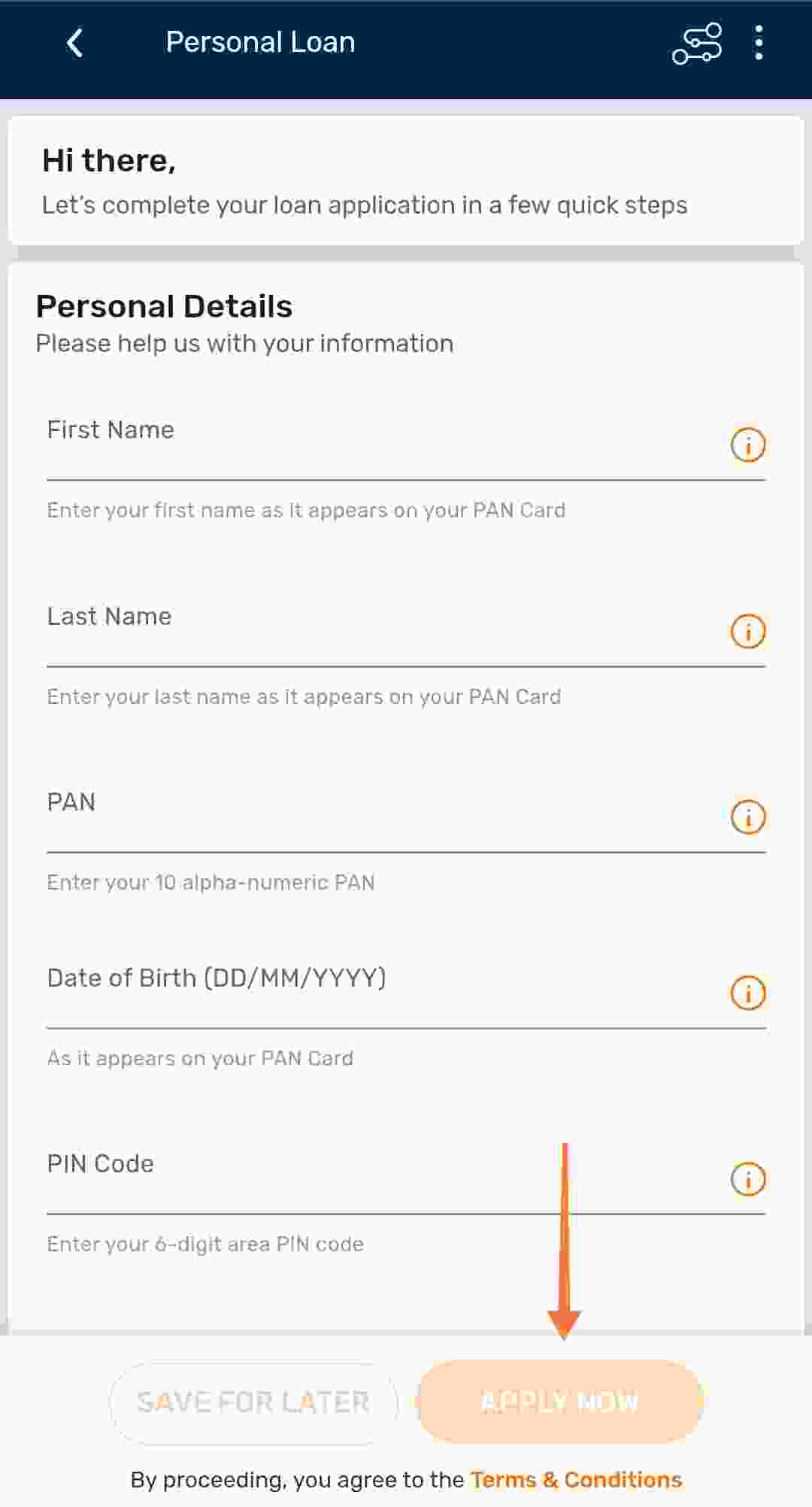

- Apply Now Ke Buttun Par click Karne ke Baad Aapke Samne Ek Registration Page Khulke Aayega Jo Is Tarah Ka Hoga

- Ab, dhyan se saari maangi gayi jaankari enter karen aur Submit option par click karen.

- Submit option par click karne ke baad, aapka Bajaj Finserv Personal Loan ka online aavedan prakriya shuru ho jayega.

- Online aavedan jama hone ke baad, 24 ghanton ke andar aapke khate mein dhan rakha jayega.Dhyan dein ki prakriya samay aur dhan transfer ke liye alag-alag karanon par nirbhar karti hai, jaise ki verification prakriya, loan manzoori aur banking vidhiyan. Yeh salah di jati hai ki aap Bajaj Finserv ki adhikarik website ya unke customer support se sampark karen, jisse aapko sahi aur up-to-date jaankari prapt ho sake loan aavedan prakriya aur dhan vyavahar ke bare mein.

Bajaj Finserv Personal Loan:- Quick Link

| Bajaj Finserv Loan Apply | Click Here |

| Bajaj Finserv App | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

SUMMARY

Is article mein humne Bajaj Finserv Personal Loan ko online prakriya ke dwara prapt karne ke bare mein vistrit jaankari pradan ki hai. Ab, Bajaj Finserv Personal Loan ki madad se aap aasani se ek personal loan prapt kar sakte hain, jismein aapko takriban ₹35 lakh tak ka loan mil sakta hai, aur wo bhi bina kisi taklif ke. Agar aap Bajaj Finserv Personal Loan ka fayda uthana chahte hain, toh is article mein di gayi jaankari ko dhyan se padhein, diye gaye kadamon ka palan karen aur online loan ke liye aavedan karen.

Doston, mujhe ummeed hai ki aap sabne is article ko ant tak padha hoga aur ise bahut hi jaankari bhara maana hoga. Mujhe asha hai ki aapko yeh article pasand aaya hoga, aur main aap se yah anurodh karta hoon ki aap is article ko like, share aur comment karen.

Dhyan dein ki Bajaj Finserv Personal Loan ki upalabdhi aur shartein parivartit ho sakti hain. Loan aavedan prakriya aur yogyata niyamon ke bare mein sabse sahi aur updated jaankari ke liye, adhikarik website par jaane ya seedhe Bajaj Finserv se sampark karne ki salah di jati hai.

FAQ’s – Bajaj Finserv Personal Loan

Q1. Bajaj Finserv Personal Loan ke through mujhe kitna adhikta rashi ka loan mil sakta hai?

A1. Bajaj Finserv Personal Loan ke through aap ₹100,000 se lekar ₹2,500,000 tak ka loan prapt kar sakte hain.

Q2. Bajaj Finserv Personal Loan ke liye bharat dar ka kya hai?

A2. Bajaj Finserv Personal Loan ke liye bharat dar saalana 11% se 25% tak hai. Halaanki, aapke loan par lagu hone waali bharat dar alag-alag karanon par nirbhar karti hai.

Q3. Bajaj Finserv Personal Loan ke liye samay-simaa kya hai?

A3. Bajaj Finserv Personal Loan aapko 12 mahine se lekar 60 mahine tak ki muddat mein bhugtaan karne ki suvidha pradan karta hai. Aap apni bhugtaan kshamata ke anukool ek samay-simaa chun sakte hain.

Q4. Bajaj Finserv Personal Loan ke liye yogyata niyam kya hain?

A4. Bajaj Finserv Personal Loan ke yogyata niyamon mein umar, aay, rozgaar ki sthirta, credit score, aur anya karan shamil hote hain. Yogyata niyam ke vishay mein vistar se jaankari ke liye, adhikarik Bajaj Finserv website ya unke customer support se sampark karna sahi rahega.

Q5. Bajaj Finserv Personal Loan ke liye avashyak dastavez kya hain? A5. Bajaj Finserv Personal Loan ke liye avashyak dastavez shamil hote hain pahchan pramaan patra, pata pramaan patra, aay dastavej, bank jama khaate ki nakal, aur anya saambandhit dastavez. Dastavezon ki vistarpoorn soochi ke liye, adhikarik Bajaj Finserv website ya unke customer support se sampark karein.

Q6. Loan rashi prapt hone mein kitna samay lagta hai?

A6. Aapke loan ka aavedan manzoor hote hi, loan rashi aapke bank khate mein 24 ghanton ke andar transfer kar di jayegi. Halaanki, asli transfer samay alag-alag karanon aur Bajaj Finserv ke antrik prakriyon par nirbhar karti hai.

Kripya dhyan dein ki upar diye gaye prashnottar saamaany jaankari pradan karte hain aur Bajaj Finserv Personal Loan ke vishay mein sabse sahi aur updated jaankari ke liye adhikarik Bajaj Finserv website ya unke customer support se sampark karna sahi rahega.