Bank of Baroda Education Loan:-Agar aap apne lakshyaon ko shiksha ke madhyam se paana chahte hain, toh aapko ek badi raqam ki zaroorat hogi. Lekin agar aapke paas paiso ki kami hai aur aapki shiksha se judi yatra mein rukawat hai, toh ghabrane ki zaroorat nahi hai. Ab aap Bank of Baroda Education Loan ka fayda utha sakte hain, jismein aapko ₹1,000,000 tak ka karz liya ja sakta hai. Is article mein hum aapko is loan ke bare mein vistaar se jaankari denge aur aapko online aavedan karne ka step-by-step process bhi batayenge.

Is article ko padhkar aap Bank of Baroda Education Loan prapt kar sakte hain. Loan se judi saari zaroori jaankari yahan pradan ki jayegi. Mahatvapurn baat yah hai ki yah loan kewal vidyarthiyon ke liye uplabdh hai, jisse unhe unchi shiksha prapt karne aur apne uddeshyon ko poora karne ki anumati milti hai. Bank of Baroda Education Loan humare desh ke yuvaon ko pradan kiya jata hai, jisse unhe apni uchch shiksha ki or badhne ke liye avashyak arthik sahayata prapt karne ki anumati milti hai.

Agar aap ek Students hain aur Bank of Baroda Education Loan prapt karna chahte hain, toh aapko avashyak dastavez aur ghar baithe online aavedan karne ka process ke bare mein jaanana chahiye. Is article mein in muddon par poora vistaar se jaankari di gayi hai, jisse aap ant tak padhkar saari zaroori jaankari jama kar sakte hain.

Bank of Baroda Education Loan – Highlights |

| Name Of Article | Bank of Baroda Education Loan |

| Type of Article | Others |

| Name of the Bank | Bank of Baroda |

| Apply Mode | Online |

| Type of Loan | Education Loan |

| Processing Fee | Zero |

| Interest rates | 9.15% Up to 10% |

| Loan Amount | ₹50 Thousands Up to 10 Lac |

| Official Website | https://www.bankofbaroda.in |

Bank Of Broda Se Education Loan Turant Aise Le Ghar Baithe – Bank of Baroda Education Loan

Hum sabhi sammanit pustakalaya, yuva aur vidyarthiyon ko hardik badhai dete hain, jo is article ko padh rahe hain. Main mazbooti se vishwas karta hoon ki aap ek aise vidyarthi hain, jo shiksha se judi ek loan ki zaroorat hai. Agar aap Bank of Baroda Education Loan Bank of Baroda ke madhyam se prapt karna chahte hain, toh aapko online aavedan karna hoga. Bank of Baroda Education Loan ke liye kaise aavedan karein?

Is article mein ek poora step-by-step margdarshak sath hi Bank of Baroda Education Loan ke liye aavedan karne ke liye saari zaroori jaankari di gayi hai. Is article mein pradan ki gayi jaankari ko padhkar aap loan se judi saari details prapt kar sakte hain aur apna online aavedan prarambh kar sakte hain. Aavedan karne se pahle, is article mein loan ki visheshataon aur avashyak dastavezon par bhi vishesh bal diya gaya hai, jise aap dhyan se padhein.

Bank of Baroda Education Loan – Benefits?

Bank of Baroda Education Loan – Fayde

Bank of Baroda Education Loan vidyarthiyon ko unki uchch shiksha ke liye arthik sahayata pradan karne ke kai fayde offer karta hai. Loan ke kuch mahatvapurna fayde hai:

- High Loan Amount: Bank of Baroda Education Loan vidyarthiyon ko ek badi raqam, takriban ₹1,000,000 tak, udghatan karne ki anumati deta hai, jisse unhe apne shiksha se judi vyayon ko pura karne ke liye paryapt arthik sahayata mil sake. Isse yah surakshit hota hai ki vidyarthi apne pasandeeda kursiyon ko pursue kar saken aur apne akademik lakshyon ko poora kar saken.

- Flexible Repayment Options: Loan vyavastha lachili vapsi vyavastha pradan karta hai, jisse vidyarthi ko lambi avadhi mein aasaani se aasani se udhar liye gaye rakam ka bhugtan karna hota hai. Yeh suvidha vidyarthiyon ko apne arthik prabandhan ko sahi tarike se sambhalne mein madad karti hai, bina adhik bojh banaye.

- Competitive Interest Rates: Bank of Baroda uchch shiksha loan pratiyogita-kshamak byaj dar par pradan karta hai, jisse yah surakshit hota hai ki vidyarthi apne shiksha ke liye suvidhajanak vitta prapt kar sake. Byaj dar ko visheshagya maanakon ke anuroop sambhav banaya gaya hai.

- Moratorium Period: Loan ke saath moratorium awadhi bhi hoti hai, jisme udharak ko koi bhi vittiya vapis karne ki avashyakta nahi hoti hai. Isse vidyarthi apni padhai par dhyan kendrit kar sakte hain bina kisi turant vapisi bhugtan ki chinta kiye.

- Wide Range of Eligible Courses: Bank of Baroda Education Loan vyapak kursiyan shaamil karta hai, jaise ki Bharat aur videsh mein aavartit graduate aur postgraduate programs. Vidyarthi vibhinn vidya kshetron mein padhai kar sakte hain, jaise ki engineering, medical, management, kala aur vigyan, aur anya.

- No Margin Money: Loan 100% vittiyon pradan karta hai, yaani ki koi margin rashi ya pehle se bhugtan ki avashyakta nahi hoti hai. Vidyarthi ko loan prapt karne ke liye kisi bade rashi ko pehle se jama karane ki zaroorat nahi hoti hai.

- Co-applicant Flexibility: Loan mein sahaayak avedak, jaise ki maata-pita ya dekhe-bhaal karne waale, ko shaamil karne ki anumati hai, jisse loan ki

| No Collateral for Premier Institutes | Moratorium Period: Course Period +1 year |

| No prepayment charges | Attractive Interest Rates |

Bank of Baroda Education Loan – Eligibility

Bank of Baroda Education Loan ke liye yogyata kya hai?

Bank of Baroda Education Loan prapt karne ke liye nimnlikhit yogyataon ko poora karna zaroori hai:

- Bharatiya Nagrik Hona: Loan ke liye aavedan karne wale vyakti ka Bharatiya nagrik hona zaroori hai.

- Uchch Shiksha Prapt Karne Ki Ichha: Loan ka upyog kewal uchch shiksha prapt karne ke liye kiya ja sakta hai. Ismein graduation, post-graduation, professional courses, aur anya aavartit courses shaamil hote hain.

- Prasiddh Sanstha Ya Vishvavidyalaya Se Admission: Loan ke liye, vyakti ko prasiddh sanstha ya vishvavidyalaya mein pravesh prapt karna chahiye.

- Uchch Shiksha Ke Vyayon Ke Liye Aavedan Karna: Loan ka upyog uchch shiksha ke vyayon, jaise padhne ki fees, hostel fees, pustakon ka kharid, upakaranon ka kharid, aur anya saamanon ke liye kiya ja sakta hai.

- Credit History: Bank of Baroda Education Loan ke liye, vyakti ka credit itihaas zaroori hai. Ek accha credit score aur pichhle karz bhugtan ki achhi record vyakti ke liye faydemand hoti hai.

| Student | Not more than 40 Years, at the time of availing Loan |

| Co-Applicant | Minimum-21 Years, Maximum (58 Years for Salaried & 65 Years for Non-Salaried) |

Yeh hai kuch mukhya yogyataen Bank of Baroda Education Loan prapt karne ke liye. Loan ke niyam aur shartein badal sakti hain aur bank ki nirdharit neeti par nirbhar karti hain. Isliye, loan ke liye yogyata par puri jaankari ke liye bank ke adhikariyon se sampark karna zaroori hai.

Bank of Baroda Education Loan – Required Documents List ?

Bank of Baroda Education Loan ke liye avashyak dastavezon ki list hai:

- Aavedan Patra: Bank of Baroda dwara pradan kiya gaya loan aavedan patra, jismein vyakti ki vyaktigat aur arthik jaankari hoti hai.

- Identity Proof: Vyakti ka pahchan praman patra, jaise Aadhaar Card, Voter ID Card, Passport, ya PAN Card, bank ke dwara maana gaya valid ID proof.

- Address Proof: Vyakti ka pata praman patra, jaise Aadhaar Card, Voter ID Card, Passport, ya anya prasiddh pata praman patra, jo vyakti ke nivas sthan ko sahi tarike se pramanit karta hai.

- Age Proof: Vyakti ke umr praman patra, jaise janm tithi pramanit karne wala dastavez, jaise janm patra, school/college ki pramanit umr, ya anya maanyata prapt umr praman patra.

- Admission Proof: Vyakti dwara pramukh sanstha ya vishvavidyalaya mein pravesh prapt karne ka praman, jaise sanstha dvara diya gaya pravesh patra, prasiddh sanstha ke dastavez, ya pravesh sankhya praman patra.

- Academic Documents: Shiksha sambandhit dastavez, jaise 10th aur 12th ki marksheet, graduation ki marksheet aur praman patra, aur anya prasiddh sanstha dvara diya gaya academic record.

- Income Proof: Karz ki wapisi ke liye vyakti ki aay ka praman patra, jaise salary slip, income tax return (ITR), ya anya maanyata prapt income proof dastavez.

- Bank Statements: Aakhiri 6 mahine ke bank ka khata utaaro (bank statements), jo vyakti ke vyavsayik aur vyaktigat vittiya sthiti ko pramanit karta hai.

- Passport-size Photographs: Vyakti ki passport-size tasveerein, jo aavedan patra, documents, aur bank ki jaroorat ke liye upyog ki jaati hai.

Yeh hai kuch mukhya dastavez Bank of Baroda Education Loan ke liye. Bank dwara nirdharit dastavez aur pramano ki sankhya alag alag ho sakti hai. Isliye, loan ke liye aavedak ko bank ke adhikariyon se sampark karke sahi aur up-to-date dastavezon ki jaankari leni chahiye.

Simple And Quick Apply Online Bank of Baroda Education Loan?

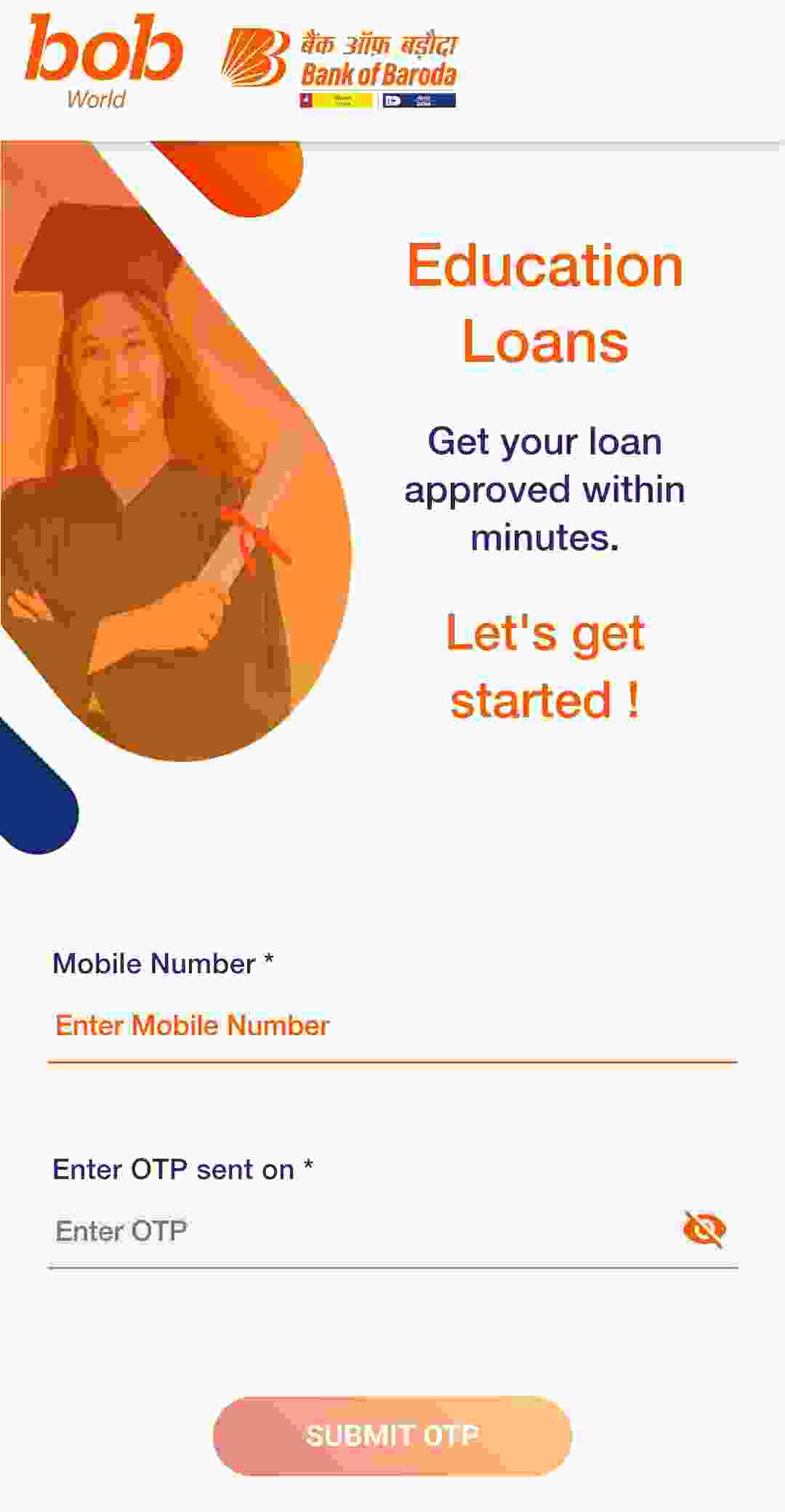

Bank of Baroda Education Loan ke liye online aavedan kaise karein? Yahan online aavedan karne ka step-by-step process diya gaya hai:

- Bank of Baroda ki official website par jaayein: Bank of Baroda ke official website par jaayein (www.bankofbaroda.in).

- “Products” section mein jayein: Website ke homepage par “Products” section ko khojein aur us par click karein.

- “Loans” category chunein: “Products” section mein se “Loans” category ko chunein.

- “Education Loan” option select karein: “Loans” section mein se “Education Loan” option ko chunein.

- “Apply Online” par click karein: Education Loan ke page par, “Apply Online” ya “Online Application” option par click karein.

- Aavedan form bharein: Online aavedan form mein apni vyaktigat jaankari, shiksha se judi jaankari, arthik jaankari, aur anya zaroori details ko sahi tarike se bharein.

- Dastavez upload karein: Aavedan form ke saath saari avashyak dastavez aur praman patra ko scan karke upload karein. Yeh dastavez aapke aay, pahchan praman patra, address praman patra, umr praman patra, admission praman patra, academic documents, bank statements, aur tasveerein shamil kar sakte hain.

- Form ki jaanch karein: Aavedan form aur upload ki gayi dastavez ko ek baar aur jaanch lein, sahi tarike se bhara gaya hai aur sabhi zaroori dastavez sahi tarike se upload hue hain.

- Submit karein: Aavedan form aur dastavez ko jaanchne ke baad, “Submit” ya “Apply” button par click karein.

- Aavedan ki pushti karein: Aavedan jama hone ke baad, aapko aavedan ki pushti karne ke liye ek samagri prapt hogi. Ismein aapko aavedan sankhya aur anya mahatvapurna jaankari hogi.

- Follow-up karein: Aapko diye gaye aavedan sankhya aur anya reference details ka upyog karke aap apne aavedan ka follow-up kar sakte hain, jaise ki uski sthiti, avagaman ki pushti, aur anumodan ka samay.

Is tarike se aap Bank of Baroda Education Loan ke liye online aavedan kar sakte hain. Yadi aapko kisi bhi prakar ki sahayata ki zaroorat ho, toh aap bank ke adhikariyon se sampark kar sakte hain ya unki official website par di gayi sahayata prapt kar sakte hain.

Bank of Baroda Education Loan:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Conclusion

Is lekh mein humne online Bank of Baroda Education Loan ke baare mein vyapak jaankari share ki hai. Ab Bank of Baroda ke madhyam se aap ₹50,000 se lekar adhikatam ₹1,000,000 tak ke shiksha loan ka labh utha sakte hain.

Shiksha loan lekar aap uchch shiksha ko puri shiddat se anushasan ke saath pursue kar sakte hain aur apne lakshyaon ko prapt kar sakte hain. Bank of Baroda Education Loan ke liye aavedan kaise karna hai, uska vistaarit prakriya is lekh mein share kiya gaya hai.

Dosto, ummeed hai ki aap sabne is lekh ko ant tak padha hai aur ise behad upyogi paya hai. Mai aap se nibedan karta hu ki aap is lekh ko pasand, share aur comment karein, jisse aapko isse anand mila hai.

FAQ’s – Bank of Baroda Education Loan

- Q: Bank of Baroda Education Loan kya hai? A: Bank of Baroda Education Loan ek aarthik utpaad hai jo Bank of Baroda dwara pradaan kiya jata hai, jiske madhyam se chatraon ko unki uchch shiksha ke kharche mein sahayata pradaan ki jati hai.

- Q: Bank of Baroda Education Loan ke liye kya yogyata mukhya hai? A: Bank of Baroda Education Loan ke liye yogyata mukhya roop se Bharatiya nagrik hona, uchch shiksha ko pr pursue karne ki ichha hona, ek manyata prapt sanstha mein pravesh milna, aur bank ke credit itihaas ki maang ko poora karna shamil hai.

- Q: Bank of Baroda Education Loan mein kitna loan raashi upalabdh hai? A: Bank of Baroda Education Loan mein loan raashi ₹50,000 se lekar adhikatam ₹1,000,000 tak ho sakti hai, yeh kursi aur sanstha par nirbhar karta hai.

- Q: Bank of Baroda Education Loan ke liye kya vapis bhugtan vikalpon hai? A: Bank of Baroda Education Loan mein vapis bhugtan vikalpon mein sanstha avadhi ke dauran ek moharatan avadhi shamil hai aur kursi samapt hone ke baad tak karz ki wapasi avadhi up to 15 saal tak ho sakti hai.

- Q: Bank of Baroda Education Loan ke liye jamin parakh ki jarurat hai? A: ₹4,00,000 tak ke karz ke liye, jamin ya teesri taraf ki gaurantee ki jarurat nahi hoti hai. Halka zyada loan raashi ke liye, jamin ya upyukt teesri taraf ki gaurantee ki avashyakta ho sakti hai.

- Q: Bank of Baroda Education Loan ke liye byaj dar kya hai? A: Bank of Baroda Education Loan ke liye byaj dar loan raashi, kursi prakar aur upabhokta dwara pradaan ki gayi jamin ke aadhar par tay kiya jata hai. Byaj dar bank ke niyamo ke anusar badal sakti hai.

- Q: Kya Bank of Baroda Education Loan ko online aavedan kiya ja sakta hai? A: Haan, Bank of Baroda Education Loan ko online aavedan kiya ja sakta hai bank ke official website ke madhyam se. Online aavedan prakriya suvidha aur pahunch ki sahajata pradan karti hai.

- Q: Bank of Baroda Education Loan ke liye kin dastavezon ki avashyakta hoti hai? A: Avashyak dastavezon mein pahchan praman patra, pata praman patra, pravesh praman patra, shiksha sambandhit dastavez, aay praman patra, bank ka utaaro, aur tasveerein shamil ho sakti hain. Vishesh dastavez ki avashyakta vyakti ki sthiti aur bank ke niyamo par nirbhar