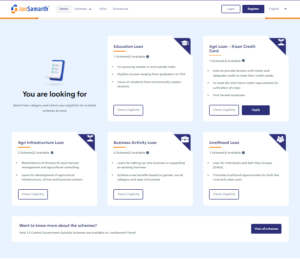

Government Portal Instant Loan:-Agar aapko apne business ke liye sarkari loan chahiye toh aapke liye ek good news hai. Sarkar ne Jan Samarth Portal launch kiya hai, jisse aap government portal instant loan ke liye aasaani se apply kar sakte hain. Hum aapko iss article mein government portal instant loan ke liye apply karne ka detailed information denge, jisme required documents aur eligibility criteria bhi shaamil hain.

Government portal instant loan ke liye apply karne ke liye aapko kuch document aur eligibility requirements fulfill karni padengi. Hum aapko inn documents aur requirements ki ek estimated list denge taaki aap unhe easily arrange karke portal se loan ke liye apply kar sakein.

Articale ke Last Me Hum Aapko Quick And Easy Link Provide Karenge Jaha Se Aap Asani Se Simple Way Me Government portal instant loan ke liye Apply Kar sakte hai

Government Portal Instant Loan – Highlights

| Name of the Portal | Jan Samarth Portal |

| Name of the Article | Government Portal Instant Loan |

| Type of Article | Latest Update |

| Detailed Information Of Government Portal Instant Loan? | Please Article ko Completely Read Kare. |

Ab Is Goverments Portal Se Paye Hatho Hath Loan Ye Hai Puri Process – Government Portal Instant Loan?

Hum sabhi readers aur young individuals ko garam-garam welcome karte hain jo apne business ya anya purposes ke liye loan lena chahte hain. Isliye, iss article ke zariye, hum aapko Government Portal Instant Loan ke baare mein detailed information dena chahte hain.

Dhyan rakhein ki Government Portal Instant Loan ke liye apply karne ke liye aapko ek online application process follow karni padegi. Hum aapko application process ki complete information denge taaki aap aasaani se iss sarkari loan ke liye apply karke uske benefits ka fayda utha sakein.

Article ke end mein, hum aapko quick links bhi denge taaki aap easily similar articles ko access kar sakein aur unse benefit le sakein.

Advantages of Government Portal Instant Loan:

1. Speed aur Convenience: Government portal instant loans ek remarkable level ki speed aur convenience offer karte hain. Pura application process online complete kiya ja sakta hai, jisse borrowers ko physical branches visit karne aur lengthy paperwork deal karne se bacha jaata hai. Simplified digital forms aur streamlined verification processes ke saath, borrowers ghar baithe loans ke liye apply kar sakte hain aur funds quickly receive kar sakte hain, kabhi-kabhi minutes ya hours mein. Yeh speed aur convenience financial emergencies mein invaluable prove hoti hain jab immediate access to funds essential hota hai.

2. Reduced Documentation: Traditional loan applications mein often ek complex web of paperwork aur documentation involve hota hai. Contrast mein, government portal instant loans paperwork burden ko minimize karte hain by leveraging existing government databases for identity verification aur other necessary information. Yeh simplification sirf time save nahi karta but also loans ko more accessible banata hai un individuals ke liye jo extensive financial documentation possess nahi karte ya traditional banking services access karne mein difficulty face karte hain.

3. Lower Interest Rates aur Fees: Government portal instant loans often ek broader population ko affordable credit options provide karne ke liye designed hote hain. As government-backed initiatives, yeh loans competitive interest rates aur lower processing fees ke saath aate hain compared to traditional lending channels. Governments financial inclusivity promote karne aur economically vulnerable sections of society ke liye credit cost reduce karne ka aim rakhte hain. By offering lower interest rates and fees, government portal instant loans borrowing ko more affordable banate hain, helping individuals manage their finances more effectively.

4. Wider Eligibility: Government portal instant loans typically more inclusive eligibility criteria ke saath designed hote hain compared to traditional loans. While traditional lenders often heavily rely on credit scores aur extensive credit history, government portal instant loans ek more holistic approach lete hain.

Yeh loans alternative factors jaise income stability, employment history, aur government records ko consider karte hain eligibility determine karne ke liye. As a result, individuals with lower credit scores ya limited credit history bhi qualify kar sakte hain for these loans, promoting financial inclusivity aur providing access to credit to those who may have been previously overlooked by traditional lenders.

5. Financial Inclusion: Government portal instant loans ka ek key advantage hai unka contribution to financial inclusion. By leveraging technology aur digital platforms, yeh loans individuals aur formal financial services ke beech ka gap bridge karte hain. They enable those who have limited access to traditional banking services, jaise people in remote areas ya underserved communities, to access affordable credit. By providing an inclusive and accessible lending option, government portal instant loans individuals ko empower karte hain to meet their financial needs, build credit history, and improve their overall financial well-being.

Conclusion:

Government portal instant loans numerous advantages offer karte hain jo unhe ek valuable financial resource banate hain individuals ke liye jo immediate funds ki zaroorat mein hain. With their speed, convenience, reduced documentation requirements, lower interest rates and fees, and wider eligibility criteria, yeh loans ek pathway provide karte hain to financial inclusion and empower individuals to overcome financial challenges. However, it’s crucial for borrowers to assess their financial situation and borrow responsibly to ensure they can comfortably repay the loan and avoid unnecessary debt.

Required Documents For Government Portal Instant Loan?

Government portal instant loans ke liye required documents country, government agency, aur lending institution ke hisaab se vary kar sakte hain. However, yeh ek general list hai documents ki jo application process mein commonly requested ho sakte hain:

1. Identification Documents: Typically, aapko proof of identity provide karna padega, jaise ek valid passport, national ID card, driver’s license, ya any other government-issued identification document.

2. Proof of Address: Aapko apne residential address ka proof provide karna pad sakta hai. Yeh utility bills, bank statements, rental agreements, ya any official document ka form ho sakta hai jo aapka name aur address display karta ho.

3. Income Proof: Lenders often documentation require karte hain to verify your income and repayment capacity. Commonly accepted documents include salary slips, employment letters, bank statements showing regular income deposits, ya income tax returns. Self-employed individuals ko business financial statements ya tax returns provide karne ki zaroorat ho sakti hai.

4. Bank Statements: Lenders recent bank statements request kar sakte hain to assess your financial stability, cash flow, aur transaction history. Yeh unhe aapki repayment capability aur overall financial health evaluate karne mein help karta hai.

5. Employment Verification:

Depending on the loan requirements, aapko employment verification documents provide karne ki zaroorat ho sakti hai, jaise employment letters, pay stubs, ya contracts, to establish your current job status and stability.

6. Tax Identification Number (TIN): Kuch countries mein borrowers ko apna Tax Identification Number ya any related tax documents provide karna padta hai as part of the loan application process.

7. Credit History: While government portal instant loans often more inclusive designed hote hain, kuch lenders credit history information request kar sakte hain. Yeh credit reports, credit scores, ya any records of previous loans or debts include kar sakta hai.

It’s important to note ki specific document requirements vary kar sakte hain, aur kuch lenders additional ya alternative documentation requirements rakh sakte hain. It’s recommended to visit the government portal ya lending institution’s website to get accurate and up-to-date information on the required documents for applying for a government portal instant loan in your specific location.

Government Portal Instant Loan:- Quick Link

| Direct Link To Apply Online | Click Here |

| Official Website | Click Here |

| WhatsApp Group | Click Here |

| Home Page | Click Here |

| Telegram Group | Click Here |

Conclusion

Iss article mein humne aapko Government Portal Instant Loan ke baare mein detailed information provide ki hai aur saath hi saath complete online application process bhi bataya hai. Humara aim hai ki aapko iss sarkari loan ke liye easily apply karne mein aur uske benefits uthane mein madad mile.

Hum ummeed karte hain ki aapko yeh article informative aur helpful laga. Agar aapko pasand aaya toh please iss article ko like, share, aur comment karein.

FAQ’s – Government Portal Instant Loan

Q1: Government portal instant loan kya hai?

Government portal instant loan ek type of loan hai jo online platform ke through offer kiya jata hai jo government agency ya financial institutions ke saath collaboration mein provide kiya jata hai. Yeh loans quick access to funds provide karne ke liye designed hote hain, with a simplified application process aur swift approval and disbursal.

Q2: Government portal instant loan ke liye kaun eligible hai?

Eligibility criteria specific loan program aur government agency jo provide karti hai ke hisaab se vary kar sakte hain. However, government portal instant loans typically inclusive designed hote hain, targeting a broader population. Different income levels, credit histories, aur employment statuses wale individuals eligible ho sakte hain to apply. Kuch programs prioritize reaching underserved communities and individuals with limited access to traditional financial services.

Q3: Government portal instant loans ke kya advantages hain?

Government portal instant loans offer several advantages, including:

• Speed and convenience of the online application process.

• Reduced documentation requirements compared to traditional loans.

• Competitive interest rates and lower processing fees.

• More inclusive eligibility criteria, considering factors beyond credit scores.

• Promoting financial inclusion by providing access to credit to underserved populations.Q4: Approval ke baad funds receive karne mein kitna time lagta hai?

Approval ke baad funds receive karne mein time specific government portal aur loan program ke hisaab se vary kar sakta hai. Kuch portals offer instant approval decisions, with funds being disbursed within minutes ya hours. Others may require a short review period before disbursing the funds, typically within a few business days. It’s best to check the specific loan program’s guidelines for a more accurate estimate.

Q5: Government portal instant loans require karte hain collateral ya guarantor?

Government portal instant loans often unsecured loans hote hain, meaning they do not require collateral ya guarantor. However, yeh vary kar sakta hai depending on the loan program and the lender’s requirements. Kuch loans may have specific collateral ya guarantor requirements, while others are designed to be unsecured and accessible to a wider range of borrowers.

Q6: Government portal instant loan ko kisi bhi purpose ke liye use kar sakte hain?

Government portal instant loan ko use karne ka purpose specific loan program aur uske terms ke hisaab se vary kar sakta hai. Generally, yeh loans can be used for various purposes, such as covering unexpected expenses, medical bills, education costs, home improvements, ya debt consolidation. However, it’s essential to review the loan terms and guidelines to ensure that the intended use aligns with the loan program’s requirements.

Q7: Government portal instant loans available hain small businesses ke liye ya sirf individuals ke liye?

While many government portal instant loan programs focus on individual borrowers, kuch may also provide loans specifically tailored for small businesses. These business loans may have separate eligibility criteria and requirements. It’s advisable to check the specific loan programs available in your country or region to determine if there are options for small business financing.

Q8: Government portal instant loans available hain poor credit scores wale individuals ke liye?

Government portal instant loans often have more inclusive eligibility criteria compared to traditional loans, which means lower credit scores wale individuals bhi eligible ho sakte hain to apply. Yeh loans may consider other factors such as income stability, employment history, and government records to assess eligibility. However, the specific credit score requirements and criteria can vary depending on the loan program and lender. It’s recommended to check the guidelines or contact the relevant government agency for more information on credit score requirements for their instant loan programs.

Q9: Government portal instant loan ko early repay kar sakte hain?

Government portal instant loan ko early repay karne ki ability can vary depending on the loan program and the terms and conditions associated with it. Kuch loan programs allow early repayment without any penalties, while others may have certain prepayment penalties or fees. It’s essential to review the loan agreement or contact the loan provider to understand the specific terms regarding early repayment.